Executive Summary

- A bailout package from the International Monetary Fund (IMF) in February 2017 has set Mongolia on a path to amore stable (and disciplined), economic future

- The mineral-rich country, posted strong results in late 2016 with resurgent gold and coal exports

- Confirmed foreign direct investment (FDI) from Rio Tinto alone in the years to 2020, will bolster the economy, with other multinationals primed to enter the market

- Government pro-activity is harnessing commodities’ performance and international goodwill, to encourage diversification and infrastructure spending

- A brighter, more sustainable, future is coming to Asia’s most resourceful nation

Overview

Mongolia has had a positive start to 2017. Demographically small, but with a vast landmass, it is heavily dependent on minerals, and these have performed well in recent months. Coal, gold, copper concentrate and iron ore account for around 80% of Mongolian exports, and so the extraction and pricing of these commodities is central to economic performance (NSO). China’s appetite is also key. Around 79% of Mongolia’s total exports went to its southern neighbor last year, and, so the rebound in its desire for coal, in particular, has been greeted warmly by politicians and industrialists in Ulaanbaatar. In Q1 2017, we also saw the IMF agree to a bailout, backed by the Asian Development Bank (ADB) and other countries. This has sent a positive signal to the markets, and the response has exceeded expectations. As a consequence of these developments, there is a sense Mongolia is moving from the doldrums and exhibiting the first symptoms of recovery. To build on this momentum, the country needs to look to create a more balanced economy, improve fiscal controls, invest in infrastructure and encourage FDI. The early signs of a willingness to take this medicine, are positive. If things continue in this vein, it will be an interesting, and potentially, prosperous 2017.

Mineral Rebound

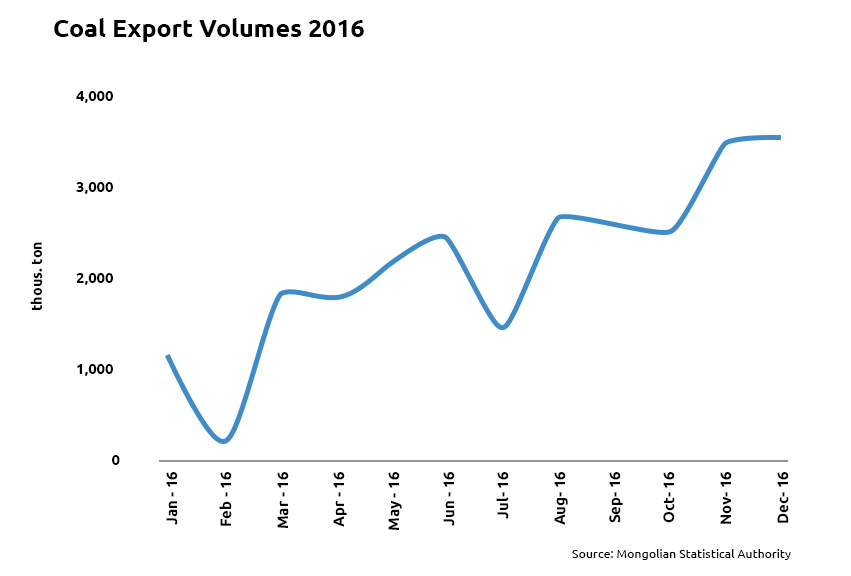

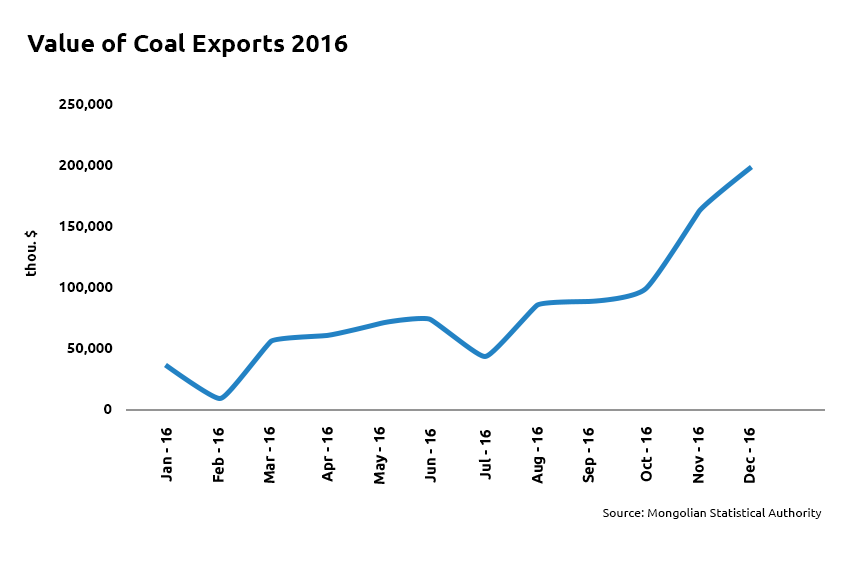

In simple terms, if there is strong demand for minerals then Mongolia benefits. After a challenging half decade, Mongolians are daring to believe earlier successes may be repeated. As the world fixated on Donald Trump’s victory in the US presidential election, two of Mongolia’s key exports were on the up: coal and gold. Coal enjoyed an excellent Q4 2016, and export volumes for December 2016 were 126% greater than in the same month of the preceding year (NSO). The performance for January and February 2017, was even better. Exports were up 289% compared with the preceding year, and the value of these exports, up 689% (NSO). In the near term, Mongolia can expect to continue to benefit from its proximity to the world’s largest consumer. To say coal is back in favor, may be premature, however, it is certainly not on the wane in the manner some policymakers hoped. Indeed, in March 2017, prices for Chinese thermal coal reached a three year high (Reuters). Even when pricing softens, Mongolian coal has experienced significant volume increases over the past twelve months which are predicted to be sustained. Coal export volumes and values for 2016 are shown in Figure 1 and 2.

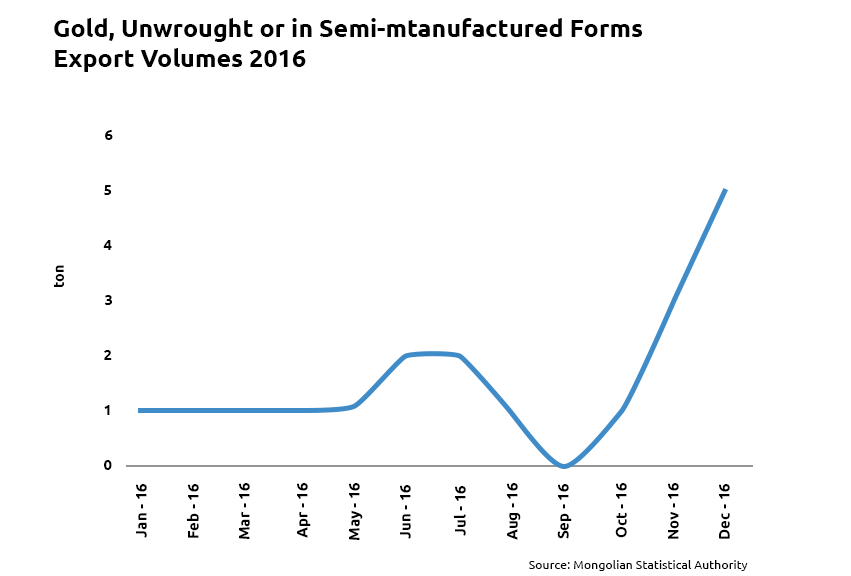

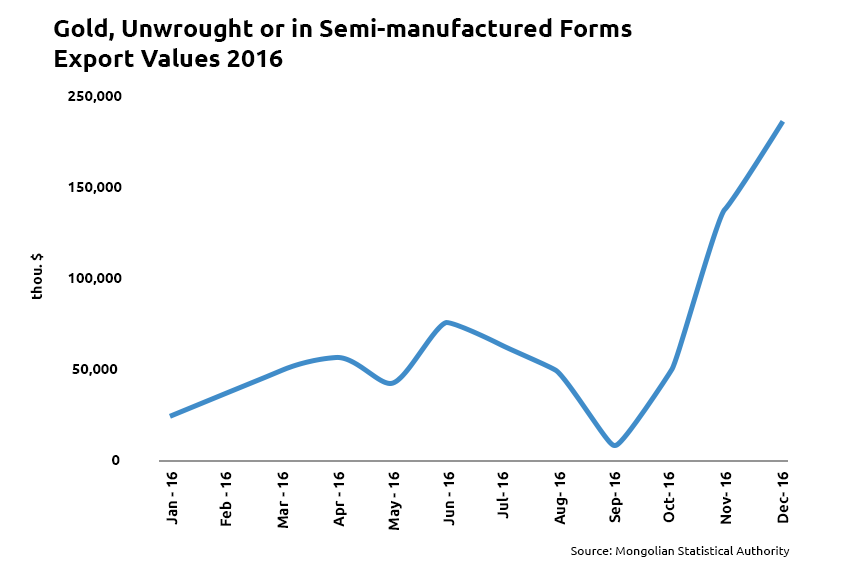

Gold – which accounts for 17% of Mongolian exports – also had a stellar 2016 (NSO). Volumes were up 178% in December relative to the previous year (NSO). It seems unlikely this rate can be sustained – and indeed, January and February figures, reinforce a cautious assessment. Nonetheless, there was a dramatic improvement in 2016 and if some of this increase is harnessed, gold will assume an important role as Mongolia moves toward recovery. As a result of robust pricing and production, the value of Mongolian gold exports was similarly strong for this period. And more exploration may build momentum. Canada’s Erdene Resources, recently announced one of its gold zones, discovered in October, had some of the highest reserves, and longest mineralized intervals, seen to date. If Erdene and others continue to find promise in the steppes, the gold industry could flourish. The performance of gold in terms of monthly values and volumes is shown in Figures 3 and 4.

Gold – which accounts for 17% of Mongolian exports – also had a stellar 2016 (NSO). Volumes were up 178% in December relative to the previous year (NSO). It seems unlikely this rate can be sustained – and indeed, January and February figures, reinforce a cautious assessment. Nonetheless, there was a dramatic improvement in 2016 and if some of this increase is harnessed, gold will assume an important role as Mongolia moves toward recovery. As a result of robust pricing and production, the value of Mongolian gold exports was similarly strong for this period. And more exploration may build momentum. Canada’s Erdene Resources, recently announced one of its gold zones, discovered in October, had some of the highest reserves, and longest mineralized intervals, seen to date. If Erdene and others continue to find promise in the steppes, the gold industry could flourish. The performance of gold in terms of monthly values and volumes is shown in Figures 3 and 4.

The story with copper – which accounts for 42% of Mongolia’s exports – is more nuanced. In the year to February 2017, prices were up nearly 29%, and major international mining conglomerates predicted a continued uptick (Frontera News). Mongolia – as the country with the twelfth largest copper reserves in the world – hoped to benefit if fundamentals continued to improve (Frontera). Over the course of 2016, however, exports peaked in August and did not recover in the latter part of the year. Whilst broadly discouraging, overall volumes were still up nearly 6% in total (NSO). Further, APIP believe this is likely to be a short term dip as exploration at Oyu Tolgoi – the most significant copper project online – is engaged in drilling through lower grade areas this year. After completion, it will move to higher quality reserves, leading to a significant uptick in performance in 2018, and especially, 2019.

The Canadian mining company, Kincora, is also making positive noises. Its CEO recently described Mongolia as ‘one of the last frontiers’ for serious extraction in the world, and is increasing its exploration activities. Some hope Kincora’s positivity may be a sign of a shift toward a more even balancing of activity between major multinational organizations. In fact, Kincora now believes itself to be more ‘aggressive’ than even Rio Tinto. More encouragingly still, some have begun to draw parallels between Chile in the 1970s at the start of its journey toward becoming the world’s largest producer.

Commodity pricing is a complex area, and not one a real estate firm should opine upon without caution. This said, even by cautious assessment, Mongolian exports are performing significantly better than recent history. If a little bit of this preferential pricing and demand can feed into the Mongolian economy, then the prospects for the coming years may be better than first imagined.

Infrastructure

Whether exploiting existing industries, or exploring new ones, Mongolia desperately needs better infrastructure. For many years, exporters have suffered, and footage from late last year, showed how the extent of the buildup in traffic at the Chinese – Mongolian border was stymying the economic recovery. In this way, the enormous Chinese, ‘One Belt, One Road’ (OBOR) initiative is beginning to excite international investors in Mongolia. OBOR is a development framework designed to better connect China with Eurasian countries and other nations further afield. It has the potential to improve access for Mongolian companies to Russian, and one day, Eastern European markets. The Chinese are committed to ensuring better freight connectivity with Europe through the development of new rail routes, and this could lead to substantial infrastructure investment in Mongolia. Beijing has stressed the importance of this project, and is not known to hold back when committing to major infrastructure investment. The future of the 164km railway linking Tavan Tolgoi (Mongolia’s largest coking coal mine), to China, will also be important. This much vaunted, but as yet undelivered project, has the potential to greatly improve the passage of coal from Mongolia to China. The current dependence on an inefficient border crossing, serves neither Mongolian exporters nor consumers well. Investors in 2017, will be looking to the Mongolian government to reaffirm its commitment to such projects and to take proactive steps to turn well-meant intentions into delivery. A positive indication of government support for improved infrastructure came in the recent approval by the cabinet of a copper concentrate factory in Umnubogi Province’s Khanbogd soum. 10% of this facility will be owned by the Mongolian government without any outlay. Quite aside from the investment this will bring, it indicates the government’s realization of the still untapped potential of Mongolia, only realizable by targeted infrastructure upgrades.

Stable Politics and Fiscal Discipline

Parliamentary elections were held in Mongolia in June 2016 and led to a landslide victory for the Mongolian People’s Party (MPP). Its success is likely to have ramifications for the elections in 2017, where the presidency is currently held by the rival Democratic Party (DP). Although there has been friction between executive and legislature, the new cabinet has shown signs of a pro-business stance. More importantly, perhaps, the bailout agreed with the IMF is based on fiscal consolidation. In February, Mongolian legislators allowed the Development Bank of Mongolia (DBM) to act independently of government. Under plans overseen by the IMF, the bank will no longer offer assistance to fiscal programs. In particular, a hyped mortgage subsidy will not receive additional funding. Some critics express concern, however, at the continuation of social spending. Measures, for instance, to include subsidization of some drug costs and a universal allowance for children in need (Reuters). Whilst correct the government must not embark on unsustainable policies, it does also need to show the Mongolian people, a bailout has wider reach and benefits than simply to pay off government debt.

One important political question which has not been adequately addressed, concerns taxation. The IMF has stated it believes Mongolian rates are low compared with other developing countries. Neil Saker, its representative in Mongolia, in fact pointed to thresholds being on par with certain countries in the Middle East (Financial Tribune). It is unclear whether there is appetite from government to increase the current 10% personal rate, however, it may be expedient in order to help restore integrity to public finances. Again, a welcome signal to the international investor community that Mongolia is fully committed to laying the foundations for growth. One last point, from a political perspective, is a sensitive one related to Mongolia’s relationship with China. Toward the close of 2016, the visit of the Dalai Lama, led to harsh recriminations from Beijing. In particular tariffs on imports and additional transit costs. Since, Reuters reports the Chinese government has expressed its hope Mongolia has learnt its lesson, and will not digress from the ‘One China’ policy, by inviting what Beijing deems to be a dangerous separatist. Mongolia – wedged between two great powers, Russia and China – historically does not like being told what to do. This time, however, the strategic importance of the Chinese- Mongolian relationship, should make the government think twice before antagonizing its neighbor.

Market Confidence

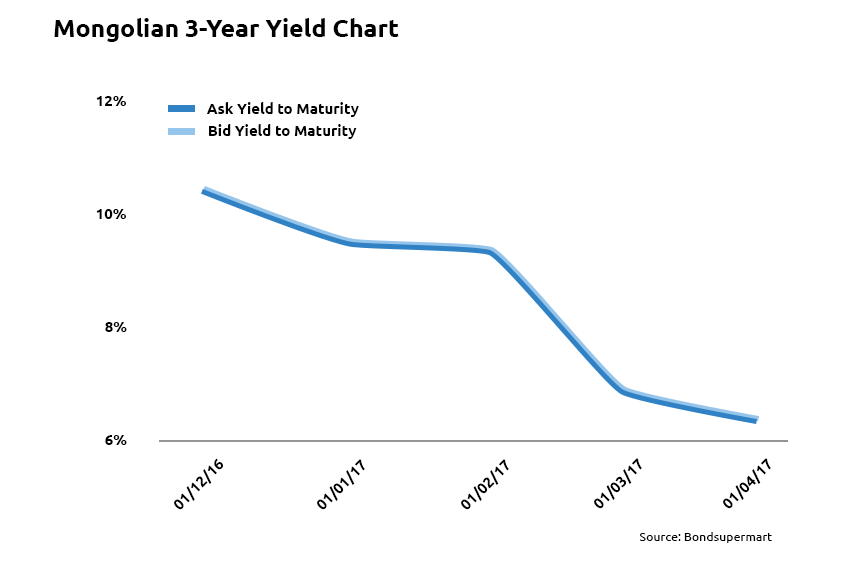

Mongolia has been the beneficiary of increased confidence since the agreement with the IMF in February. In March, a new Mongolian sovereign bond transaction, performed strongly. Much of this was an exchange on debt due to mature on 21st March. Part of it, however, was a new issuance. The yield was initially set at 8.25%, however, it soon tightened to 7.7%, and closed at 7.63% (Financial Tribune). Bonds traded up to USD108 on secondary markets shortly after pricing, suggesting further confidence. These new notes were rated B-/B – by S&P and Fitch and popularity seems based on the IMF bailout, the rebound in minerals, return of FDI and the move toward a more diversified economy (Nasdaq). Figure 5 shows recent yields.

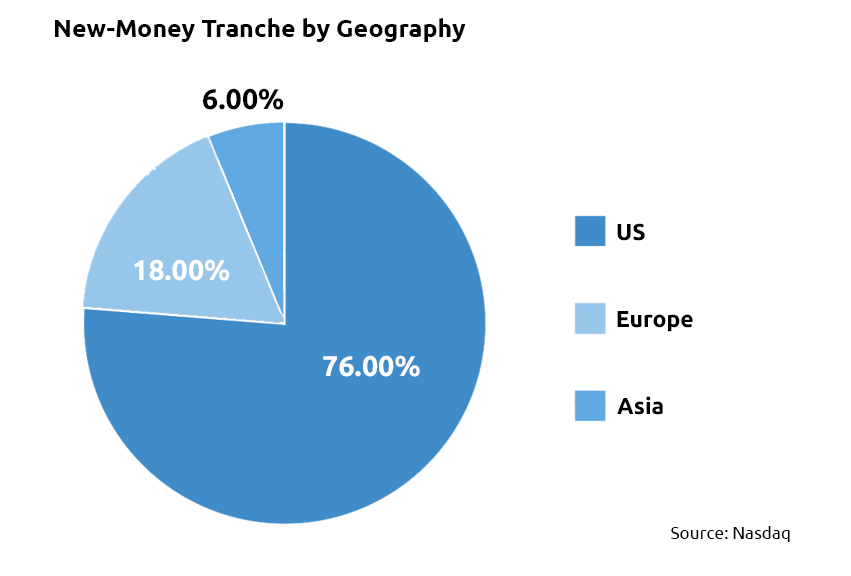

The overall process is believed to have been competently delivered with the IMF’s Mongolia representative, commenting the country, ‘…did a good job talking to investors,’ leading to the bond being five times oversubscribed (IMF). The market’s response to Mongolian sovereign debt, marks a significant improvement on recent years. In March 2016, the government sold a US$500m five-year bond with a yield of 10.88% and overall orders of only US$750m (Nasdaq). This time, for a much more modest US$124m, there were orders of US$3.3bn (Nasdaq). Although, it would have been possible to increase the overall issuance, the fact this option was rejected, shows a level of caution. Likewise, the term of the bond – set at seven years – was sensibly timed to avoid conflict with other debt commitments. Most buyers were from the US, as Figure 6 shows.

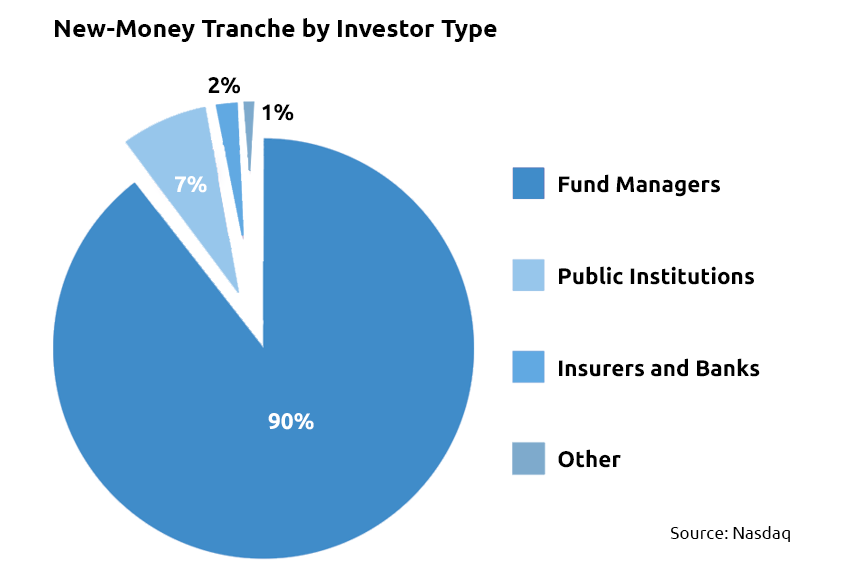

Fund managers were the principal buyers of the latest tranche. It seems they drew comfort in the near term from the IMF package as well as the agreement to extend the US$2.2bn swap line with the People’s Bank of China by three years.

It is, of course, short sighted to suggest Mongolia is once again in favor. Undoubtedly, the support of the IMF and others is what really drove the success of the March bond placement. This said, part of the reason, is the IMF and Mongolian government were in a lengthy period of negotiation – a negotiation that insisted upon a change of direction and an avoidance of past mistakes. This is why, although the IMF suggest 2017 will see muted economic performance, they also say a growth rate of between seven and eight percent should be sustainable in the medium term (IMF). Given a series of positive developments on the ground in the first quarter of 2017, it seems possible the recovery may come sooner than anticipated. One thing is clear, however: whether growth hits 8% in 2019 (as per the IMF), or if it comes before, Mongolia will once again assume the mantle as one of the world’s fastest growing economies. If the government is willing and able to use this expansion to diversify and invest, it may again become the darling of the capital markets.

Foreign Direct Investment (FDI) Returning

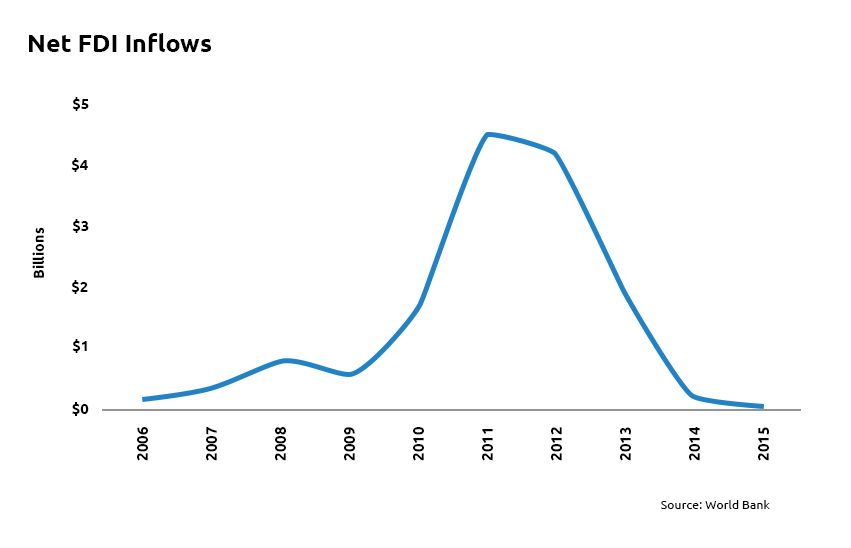

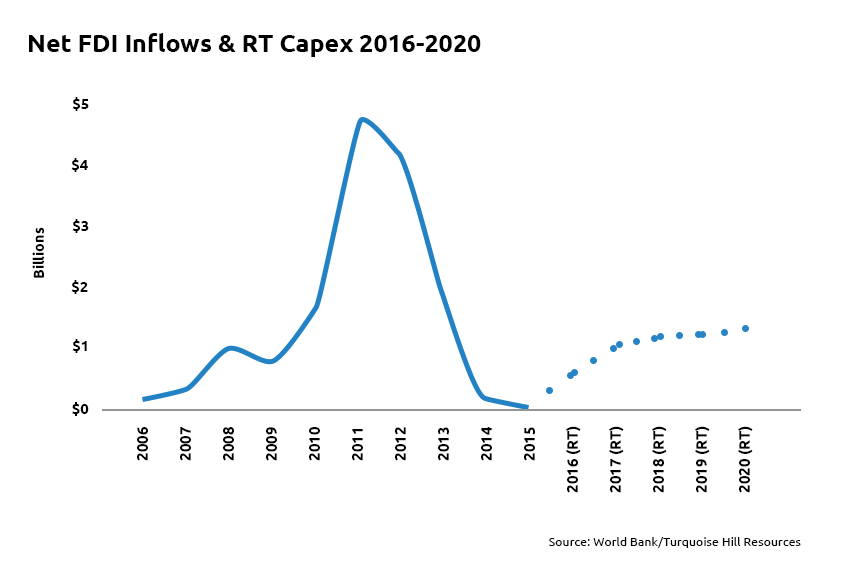

Mongolia, with its relatively small commodities-driven economy, is affected significantly by FDI flows. It is no secret these fell dramatically in recent years, with a commensurate effect on Mongolian GDP. Rio Tinto’s substantial investments had a seismic effect on Mongolian growth between 2010 and 2012, and as FDI has fallen away, so too has Mongolia’s high growth rate. Protracted negotiation did little to ameliorate this situation as shown in Figure 7.

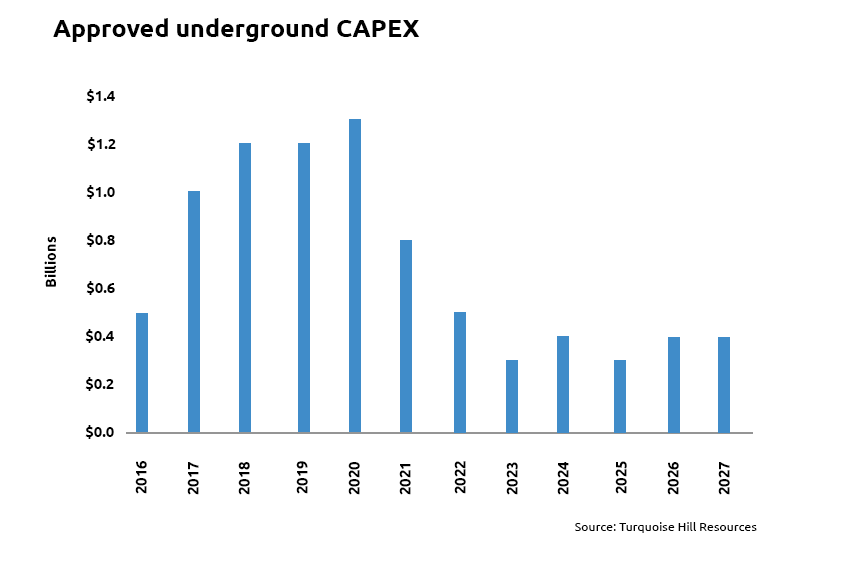

The news last year that Rio and the Mongolian government had reached an agreement which would lead to new FDI, was welcome. Focused on Oyu Tolgoi, the US$5.3bn investment could one day help it contribute to as much as 30% of the Mongolian economy (IMF). At the TD Securities Mining Conference in January 2017, Rio reaffirmed its commitment to the project and released indicative capital expenditure (capex) figures for OT in the coming years. This is shown in Figure 8.

In simple terms, the approved underground capex expenditure equates to US$2.2bn in 2017-18, or US$3.4bn in 2017-2019 (Turquoise Hill). Given total Mongolian GDP was US$11.74bn in 2015, an injection of funds of this magnitude will have a significant impact on the country’s performance. Figure 9 shows FDI in recent years and the potential of OT investment per Figure 8 alone.

No new information as to OT has emerged in Q1 2017 – rather announcements in 2016 were of particular consequence. What is clear, however, is Rio and the Mongolian Government are now so vested in the project as to make the idea of scaling it down, unthinkable. This is important not just for Mongolian GDP but investor confidence. Alongside reaffirmation of spending by Rio, positive measures have been introduced by government to encourage future FDI. Tsedev Dashdorj, the Minister of Mining and Heavy Industry recently announced at a conference in Canada, the country would be allowing significantly more exploration. Currently, the government permits exploration of around 10% of the country, but Dashdorj has suggested this will increase to 21% (Yahoo Finance). This move – welcomed by a range of stakeholders – could open access to vital copper reserves, stimulating FDI in the coming years.

Real Estate Market

Just as the success of the overall Mongolian economy is influenced by commodity pricing and FDI, the real estate sector’s performance is a reflection of these indicators. In Q1 2017, we have seen a pick-up in demand for both rentals and sales of residential property. In the case of the former, APIP’s management business, has seen some prime buildings in the city hit 100% occupancy, and in the very best, there are waiting lists for units. Demand is driven by a resurgence in the number of overseas contractors in Ulaanbaatar, especially from service companies, looking to win lucrative contracts with large mining firms. Sales have also begun to pickup. Historically, January to March, is not an especially buoyant time in the capital’s market, due to high pollution levels and the cyclical nature of local wealth creation. This year, however, prime residential units are selling, albeit at a slower pace than can be expected in summer and autumn. Anecdotally, we believe increased sales may owe to the fact, individuals who ‘held-out’ during the downturn, are now looking to liquidize assets to release capital to invest as the economy picks up. According to the Mongolian general house price index compiled by Tenkhleg Zuuch, February 2017 saw an increase of 2.85% compared with January (Tenkhleg Zuuch).

The office sector, is still afflicted by high void rates in some of the city’s central buildings. Our experience, is often this owes to a combination of over spending, and rent aspirations over and above what can reasonably be expected. There is no meaningful shortage of demand from occupiers for good retail space – especially for restaurants and bars – however, finding the right tenant mix, is leading some developers to be particularly choosy. Out-of-town also appears to be faring well. Although government-sponsored development of the land surrounding the Yarmag Road on the way to the existing airport, is still taking time, retail space in this area is appealing to Ulaanbaatar’s middle-class.

We anticipate, growing demand for office accommodation in Q2 and Q3, however, this is unlikely to be across all existing stock, and instead apply to the best Grade A buildings in the city. Lastly, there have been no significant land market transactions in Q1 2017, however, we have seen a rise in out-of-town investors seeking land in Ulaanbaatar. Areas of particular interest remain Zaisan, the area immediately surrounding the State Circus, and those few plots still available in Sukhbaatar. There are large lots still available in Khan-Uul, that APIP believe to be underpriced in the event of a significant rebound in the Mongolian economy.

Toward a More Balanced Economy

Although an improvement in the performance of Mongolia’s commodities, FDI and ability to access capital markets is to be welcomed, economic diversification is vital. Some commentators have suggested an enhanced role for agriculture and tourism. In practice, this may take many years to have a substantive effect on the country. A perhaps better (and more immediate solution) is to derive revenue from the extraction of, or trading in, other resources. A case in point, is uranium. Mongolia holds some of the largest reserves in the world, and India, in particular, is looking for ways to engage constructively. If it is possible to develop a strategic partnership, without alienating the Chinese, then Mongolia will derive benefits in terms of diversification of trading partners and economic base. The fundamentals for this enhanced partnership are strong. The Indian government of Narendra Modi has set ambitious targets to increase the amount of energy India draws from nuclear. It has signaled its intention to have 63,000 MW of nuclear power by 2032, compared with 10,000 MW today (Calcutta Telegraph). The satisfaction of this aim – with its geostrategic implications for both India and Mongolia – would help create another front in Mongolia’s more balanced economic future.

If Mongolia is to thrive, it must push for energy independence. Currently, a lack of refinement capabilities means the country produces around eight million barrels of crude oil per annum but exports most of it to China, only to then spend large sums importing fuel from Russia (Yahoo Finance). Mindful of this contradiction, the Mongolian cabinet approved plans at the end of 2016 for the development of a refinery in Dornogovi. Projected by Oxford Business Group to cost US$700m with a further US$264m to be spent on pipelines, analysts believe it could fulfil Mongolia’s diesel and petrol needs in the medium term (AKI Press). Detractors question whether in the current economic climate funds can be raised. Fortunately, the Import-Export Bank of India extended a US$1bn facility to Mongolia in 2016, and there is potential to use this. Notionally for the purposes of transport and general infrastructure, if approval is granted, it would lead to significant investment. Indeed, government estimates suggest the development of the refinery could reduce the cost of imports by around US$1bn per annum and increase Mongolian GDP by as much as 10%.

Conclusions

For close observers of Mongolia, Q1 2017, had a number of positive characteristics. For a country heavily dependent on the export of minerals, the outperformance of coal both in the tail end of last year, but more spectacularly in January and February 2017, was positive. Gold’s strong performance of Q4 2016 was not replicated in the early part of 2017; however, if the Mongolian gold industry is able to reach anywhere close to these heights it will make a sizeable contribution to the economy. Indeed, in December 2016, exports were around five times those of January that year, highlighting the need to bridge this gap. Meanwhile, the longer term prospects for copper are at the forefront of discussions of global consumption, and Kincora, has drawn parallels between Mongolia and Chile at the start of its ascent to becoming the world’s largest producer.

Meaningful diversification is not yet in train, nor is it likely to be for some years. Helpfully, however, the government is beginning to show signs it is serious about this process. A process, which will help secure a more stable future for Mongolians. Whether in discussions with India about the potential of the uranium industry (as it attempts to increase its nuclear capacity six fold by 2032), or in terms of energy independence, there seems to be real pro-activity from key stakeholders. In the case of energy, if it is possible to deliver a refinery in Dornogovi (as agreed by cabinet at the close of 2016), Mongolia could bank substantial savings and address deeply unsatisfactory current arrangements.

Perhaps given the complexity and cost of the problem, there does not seem to be a cogent infrastructure plan to prime the Mongolian economy for success. It is yet unclear when the railway linking Tavan Tolgoi and China will be delivered, and even the highway to the new Ulaanbaatar airport has suffered setbacks. The promise of ‘One Belt, One Road’ is tantalizing, however, if Mongolia is to have a stable economic future, relying on the financial muscle of its southern neighbor, alone, will not suffice. It is perhaps unfair to judge the administration on this until some more tax revenues accrue to the government. Whether this is diverted into this key strategic necessity, will be a litmus test of the government’s understanding and seriousness in addressing same of the country’s latent challenges. The political stage is set.

The IMF deal showed the government to be serious about meaningful reform. Affording independence to the DBM, was a bold step, and majoring on fiscal consolidation was reassuring. This package – which led many to let out a collective sigh of relief – was done in a politically intelligent way, however. By electing not to simply remove all government social spending programs, it sent a message to the Mongolian people that it would not simply accept rescue at any price. In another positive development, the Mining Minister, has expressed his intention of allowing exploration of more of the country’s land mass. This has the potential to raise additional revenues and allow the country to realize more of its mining and export potential. What is less clear, is whether there will be a move to change taxation to allow the country to more evenly distribute wealth in the coming years.

The consequence of some, if not all of these developments, has been a positive response from the markets. The perception of Mongolian creditworthiness has changed markedly. Clearly, this is a function of the IMF’s involvement, however, yield compression and massive oversubscription, point to an international investor community willing to take a second look. If the IMF is proven either conservative or exactly correct, a Mongolian growth rate of 8% or more at the end of the decade will again make it one of the fastest growing economies in the world. As one fund manager told us, ‘the potential is incredible, the question is economic management, political leadership.’ With these tailwinds, APIP is hopeful of the prospects for the real estate sector in Ulaanbaatar over the coming year. As FDI from Rio Tinto flows into the economy, and service providers steadily enter the city, there is going to be increased competition for the best space across all real estate sectors. In addition, we believe a Mongolian middle-class, still underserved by decent quality residential accommodation, will return to the market with confidence as the economy fires up. This is not even to speak of the potential in affordable housing and social infrastructure as the government is forced to find private partners to try and improve ger districts and promote sustainable accommodation. In short, the future is yet uncertain, but there is a palpable excitement in Mongolia. This time, however, we hope all parties to a furtive recovery, have learned the mistakes of the difficult years just passed.

For help navigating opportunities in Mongolia, please contact our

Director of Real Estate Capital Market Andrew McGregor