EXECUTIVE SUMMARY

- Robust 7% growth predicted from 2023 continuing into 2024.

- Tangible progress in development of Oyu Tolgoi mine alongside Rio Tinto, with outsized impact predicted for Mongolian economy.

- New Recovery Policy as part of Vision 2050, to increase industrialization and self reliance, partly through privatization.

- Strong pricing for main commodity groups (including copper and gold) underpinning future economic performance.

- Continued structural reform of the economy laying foundations for fiscal conservatism in a post-pandemic era.

- Sustained demand in real estate market for consumer retail, and increased interest in land for logistics and industrial.

OVERVIEW

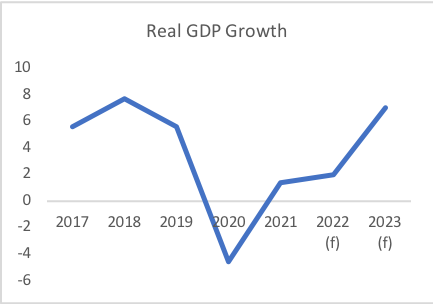

Mongolia—like many other countries—had a torrid time during the global coronavirus pandemic. Since the multilateral bailout led by the International Monetary Fund (IMF) in 2017, the country seemed on a sustainable upward trajectory. Commentators—APIP included—predicted an end to aggressive cyclicality, and a steady (high) growth rate in line with emerging Asia. The government was making meaningful structural reforms, and general agreement amongst opposing political parties, suggested there would not be significant deviation if power changed hands. Though still reliant on the Chinese economy, there were moves to diversification but also investment in the infrastructure necessary to service this large captive market. The much-vaunted Oyu Tolgoi mine— stymied by bureaucracy and corporate dispute—was gradually moving to production. This was reflected in plain economics. In 2018, real GDP growth hit 7.7%, and even in 2019, was holding firm at nearly 6%. 2020, unsurprisingly saw a contraction of 4.6%, before a modest rebound to 1.4% in 2021. Now, the IMF is predicting growth of 2% this year, followed by 7% in 2023. Much attention rightly focuses on the performance of the extractive industry, as this still forms the basis for the majority of Mongolia’s economic activity. With nearly US$2 trillion of resources estimated to sit under the steppes, mountains and plains of Mongolia, there is little to suggest demand will meaningfully abate.

Of course, fluctuations will continue to have an effect on Mongolia’s ability to recover. But perhaps more instrumental will be the ease with which products can get to market. Servicing even a small portion of Chinese appetite will be sufficient to support sustained Mongolian growth. Policymakers are increasingly singular in their focus on this strategic challenge—especially in light of the zero COVID policy of its southern neighbour. Ultimately demand side drivers are on Mongolia’s side, and the IMF, at least, feel this will enable the economy to expand.

Figure 1

Source: IMF

COMMODITIES, INDUSTRY & EXPORTS

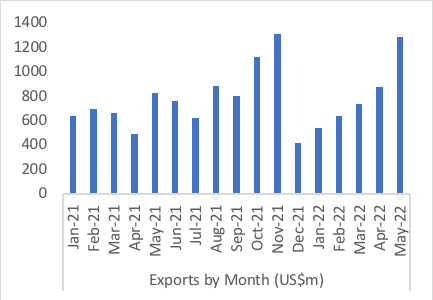

According to data from the National Statistical Office of Mongolia (NSO), there was a significant increase in the foreign trade turnover in the first five months of 2022. Totalling over US$7.2bn, this represented an increase of nearly 22% compared with the equivalent period of 2021. Separating exports and imports, the former grew by nearly 23%, while the latter, increased nearly 21%. Increased commercial engagement with other countries will be welcomed by policymakers in Ulaanbaatar, even if import figures raise questions as to Mongolia’s ability to meet its own demand. China remained the overwhelmingly dominant counterparty, with nearly 82% of exports travelling this direction. Unlike 2021 when there was a bumpy, interrupted trajectory, as Mongolia moved into its main productive seasons, 2022 has been much more consistent, suggesting a resumption of some level of normality.

Figure 2

Source: NSO

Source: NSO

Considering individual commodities and their respective export trade (in both volume and value) presents a more nuanced picture. The volume of copper concentrates increased by nearly 125,000 tonnes between January and May 2022 relative to the same period of 2021. This supported an increase in the value of copper exports by around US$300m. Coal export volumes—in part due to complexities at the frontier between China and Mongolia—fell by over 3 million tonnes, however, robust pricing meant the value of these exports reached around US$1.7bn.

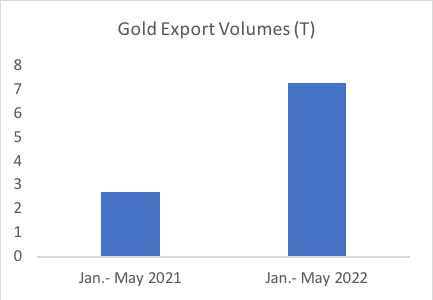

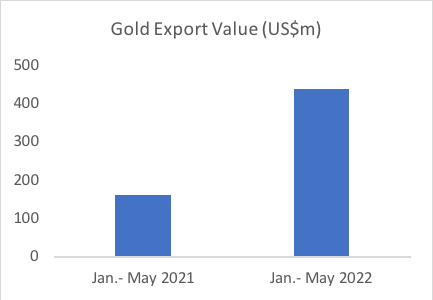

The volume of gold exports increased dramatically in January to May 2022, relative to 2021. Figures show it grew by a multiple of 2.7, yielding a total of US$440m in export value. Iron, meanwhile, suffered during this period, both in terms of volumes and values. Export volumes fell fairly precipitously, partly contributing to a drop in export values of over US$300m. Lastly, crude petroleum was not exported in 2022, leading to a net loss of over US$135m of export revenues.

Figure 3

Source: NSO

Figure 4

Source: NSO

Source: NSO

In any commodity-driven economy, it is seldom the case all demand rises or declines in formation. Instead, it is more common for some to have good months while others suffer less favourable dynamics. What is gratifying for Mongolia is at least compared with a year ago, pricing is in an advantageous position. At the border, gold is trading at US$1,698 per ounce, not far from the high of US$1,713 recorded earlier in the year, and significantly ahead of the mean for 2021. Copper pricing at US$332 per tonne is nearly three times that of May 2021, and edging up toward the high of US$366 recorded in November 2021. Likewise the price of copper concentrates levelled in May 2022 at just over US$2,200 per tonne, roughly a median point over the last eighteen months.

Global dynamics are supporting a level of increased activity from both junior and senior miners. Elixir Energy, listed on the ASX, has announced an increase in activity on its Bulag-Suuj 15 exploration well, and has increased its exposure to the Mongolian market. Meanwhile, Silver Elephant, listed on the TSX, has informed the market it intends commencing production on its coal project at Ulaan Ovoo in late 2022, once congestion in transport of commodities with China have been partially resolved.

Steppe Gold has reported increased production in May 2022. Its latest analysis records 3,800 ounces of production for the month compared with 3,370 in April and 1,532 in March.[ These figures chime with positivity from analysts who believe the gold sector is as yet under exploited and explored in the country. Aranjin Resources, has also announced a new joint venture with ION Energy, to cross collaborate on exploration for both copper and nickel.

As we look beyond the summer, the vexed question of Oyu Tolgoi will gain in salience. With sustainable production billed for the first quarter of 2023, important questions remain as to the corporate structure of the project. Rio Tinto resolved its longstanding dispute with the Mongolian government by waiving US$2.4bn in debt, earlier in the year, but is now seeking overall control. With the mine such a key determinant of longer-term Mongolian prosperity, its resolution is in the interests of all stakeholders, both public and private.

FOREIGN DIRECT INVESTMENT, EXCHANGE AND SOVEREIGN DEBT

The travails of the Mongolian tughrik have again come into focus in the early part of 2022. It has been losing value relative to the dollar since January, with a potent mixture of factors weakening its underlying position. Inflation—rising everywhere—has likewise accelerated in Mongolia due to the war in Ukraine affecting both the price of wheat, and Russian gas. Anecdotal evidence has pointed to a decline in the dollar supply in the country, with a recent sell-off to Russian purchasers. Stabilizing the situation will become a pressing concern for the government, particularly if the dollar continues to strengthen against the tugrik.

In May 2022, the monthly average exchange rate to the Chinese Yuan was 464 MNT- a depreciation of 21 compared with May 2021. It was nonetheless, an increase of 9 compared with the preceding month. The MNT rate to the Russian Rouble in May 2022, represented a reduction of 10 compared with last year, and 10 related to April 2022. Notwithstanding global turbulence, efforts will need to be made to further shore up the currency.

In May, Fitch affirmed Mongolia’s Long Term Foreign Currency Issuer Default Rating at ‘B’ with a stable outlook. In a comprehensive assessment of the country’s macroeconomy, it highlights Chinese border issues as a significant impediment to a higher rating. This combined, with geopolitical uncertainty, means it only attains a B grading. The authors likewise point to low foreign exchange reserves, and impending maturities. Fitch project foreign currency reserves of US$3.6bn by year end 2022, just over three times current external payments. With US$733m of external bonds reaching maturity in late 2023, there are meaningful contingent liabilities upcoming. This said, the Finance Ministry, is considering means to restructure, and possible early repayments to enhance Mongolia’s position. Whether this will be possible, remains to be seen, however, Fitch acknowledge, such changes could have a material impact on the creditworthiness of Mongolian sovereign debt, and therefore its outlook both near, and mid-term.

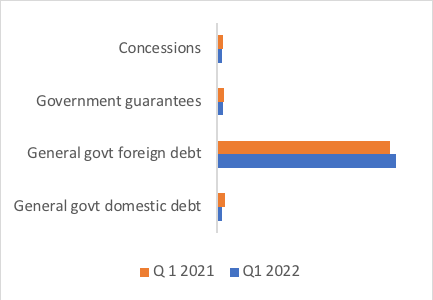

As at the end of the first quarter 2022, the Ministry of Finance reported external debt was 92% of the total, domestic debt was 2.4%, government loan guarantees amounted to 3%, while the residual was in concessions. These figures demonstrate general government foreign debt has increased as a proportion relative to the same period of 2021, at the expense of all other segments of government borrowing. While perhaps to be expected during unprecedented circumstances, terms and tenor will likely be adjusted.

Figure 5

Source: Ministry of Finance

Source: Ministry of Finance

DIVERSIFICATION & INFRASTRUCTURE

Energy independence for Mongolia, like any other country is of critical importance. Current pricing of both oil and gas, serve to highlight its vulnerability to shocks caused outside its direct control. News, therefore, that there have been tangible progress against green hydrogen projects (including reaching partial agreements on funding), have excited interest. With a supportive legal framework and indication of significant resources, it may act as a catalyst for further investment in the sector.

Keen Mongolia-observers have long been aware an important area of diversification could come in the tourism sector. Like in many developing countries, hospitality (if appropriately managed) can have an outsized downstream impact for people and place. At the moment, it is still an underserved market, in spite of being one of the last great wilderness areas left in Asia. According to a recent study compiled by the World Bank entitled ‘Fostering inclusive tourism in the aftermath of COVID-19’, there is significant growth potential.

In 2019, before the onset of the pandemic, it accounted for around 7% of GDP, the highest on record.40 This, unsurprisingly fell significantly in 2020 and beyond. To stimulate further, requires more connectivity with the rest of the world, made possible by a less protectionist aviation sector. Further, there is a question as to what sort of tourism would suit Mongolia best. High value, low density tourism requires meaningful protection of areas of outstanding natural and ecological merit. UNESCO recently announced Lake Khuvsgul will be added to its world network of biosphere reserves. This recognition of the natural capital of this remote part of Mongolia, will help set the tone for investment in hotel provision.

This sentiment is echoed by the Mongolian Minister of Environment and Tourism, Bat-Ulzii Bat-Erdene. In a recent interview, he set a goal of receiving one million tourists in 2024, and generating US$1bn. The government is attempting to remove visa requirements for many countries, and also provide relaxed entry rules for Chinese and Russian nationals on mini breaks. Together with a push to encourage conferencing in winter, the different initiatives cohere into a viable plan to diversify the country’s leisure offering.

Part of Mongolia’s potential in the area of tourism resides in its vast size: it has a land mass comparable to Western Europe but a population of three million. It is also in this area, though, infrastructure presents a genuine issue. China recently announced the inauguration of a 1,520mm gauge railway from Erenhot to Ulaanbaatar—cutting travel times by 30%. This will have a material effect on cargo transport between the two countries, precisely at a time further economic integration has been frustrated by roadblocks and delays.

This builds on a broader push to enable the country to reach its export potential with China, in particular. A recent special feature in Foreign Policy, highlights how in spite of thirteen ports of exchange, most trade by volume has relied on antiquated Soviet railroads and substandard motorways. As the article highlights, there has been significant improvements over recent decades, but a meeting between Mongolian and Chinese counterparts in February seems to have spurred further activity. Three important lines are due to all come fully online this year: Tavan Tolgoi-Zuunbayan, Tavan Tolgoi-Gashuunsukhait and Zuunbayan-Khangi. Whether or not the movement from trucks to rail can support the government’s aim of US$17bn in exports by 2025- 2028, is unclear. But what it does serve to underscore is Mongolia is moving toward more modern infrastructure, vital to sustainable development.

CONSOLIDATION & REFORM

Figure 6

Source: NSO

Much attention has (rightly) been paid to fundamental structural reforms governing stewardship of the public finances. What is sometimes overlooked is the need for digital infrastructure to support a more equitable development of the Mongolian economy. The World Bank—recognizing this challenge—has committed over US$40m through the International Development Association (IDA) to help improve online public services and increase trust in financial infrastructure. Though modest in absolute terms, the push toward increasing literacy and streamlining processes, has a material effect on the tax take and the country’s fiscal position.

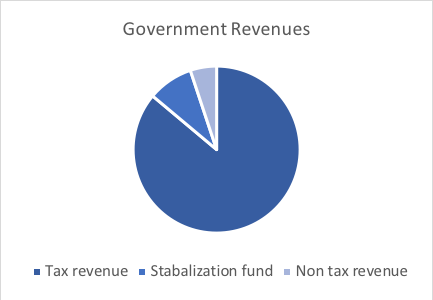

The Mongolian government received 11% more revenues in the first five months of 2022 compared with 2021. The general government budget was nearly 6 trillion MNT, which was 12% higher than last year. Consequently, there was a deficit approaching 540 trillion MNT. This being said, there has been a significant improvement in the amount of taxation levied by the governmental authorities. This was up 8% in aggregate over the period January-May, and nearly 36% month-on-month. Politicians will be hoping this momentum can be built upon so as to help in ongoing efforts to stabilize the national budget.

INTERNATIONAL RELATIONS

Mongolia’s geographic situation has long been a blessing and a curse. Sharing a land border with two of the most powerful countries in the world, will inevitably present friction as well as opportunity. The country’s diplomats have therefore grown adept at cultivating relationships beyond those with Moscow and Beijing. This so-called ‘Third Neighbour Policy’ has enabled engagement with other countries and the integration of ties of trade, but also of security.

Also sharing a border with Mongolia is Kazakhstan, whose global star is likely to rise in the mid term. In June, a meeting was held between the Ministries of Foreign Affairs, to support further integration and cooperation. With much cultural commonality and interest, the Mongolian government is keen to encourage greater interaction with industrialists in Nur-Sultan. Similarly, a detailed three-day summit was held between the foreign ministries of Mongolia and Poland to further bilateral cooperation, with an official state visit billed for later in the year.

Even in spite of these promising, more distant engagements, Mongolia must continue to wrestle with a West united in its condemnation of the Russian invasion of Ukraine, and the importance of Russia as a strategic partner. Pre-war, Gazprom announced plans for a major new gas pipeline to China which would involve the active participation of the Mongolian government. With scope for significant job creation and increased geopolitical influence, it is likely to be a sore point for policy makers who seek to continue to tread carefully in a complicated—and contested—region of the world.

The tension between Russia and many of Mongolia’s partners is likely to come into starker focus as the year progresses. In May, the Japanese Foreign Minister Yoshimasa Hayashi, issued a thinly veiled suggestion it would be best for Mongolia to pick a side. The truth is, in the field of international relations, these sorts of mixed loyalties abound. Unlike many countries, however, Mongolia has perfected its diplomatic dexterity, as it has always needed to look for partners in familiar, as well as less familiar, quarters.

POLITICS

In June 2020, the Mongolian People’s Party (MPP) won a landslide, and duly, Ukhnaagiin Khurelsukh continued as Prime Minister and leader of the cabinet. Widespread protests in the country, however, led to his resignation and replacement by Luvsannamsrai Oyun-Erdene. Controversially, Khurelsukh then ran for the presidency and was elected in 2021. In spite of concerns as to the suitability of his position (given past resignation), it nonetheless means there is a level of coordination between both legislature and executive.

Mongolia was initially praised for its response to the coronavirus pandemic—seeming, through border closures and a coordinated public health response to have avoided some of the worst consequences felt elsewhere around the world. Public perceptions of the government response remain positive, and with high levels of vaccination, there is reason to suppose, it is as well positioned as its contemporaries to address whatever waves and turbulences may yet occur.

REAL ESTATE MARKET

The real estate market in Ulaanbaatar—where most national transactions happen—has been muted during the pandemic. The construction season in Mongolia is already constrained by climate, and the effect of lockdowns and restricted mobility, limited new projects. Combine this with the simple reality many developers either face locally expensive capital, or rely on pre-sales and private equity from abroad, and flight bans and visits have been reduced.

This being said, we have seen strong, sustained local interest in both retail and food and beverage units. There remains in-country, a sufficiently consumerist middle (and upper middle) class, who during the enforced shutdown, sought to spend money locally. This was particularly evident in the months when the economy reopened, or when movement was fairly unencumbered.

At the higher end of the real estate market, we have seen strong interest in existing units. As elsewhere in the word, remote working and increased domesticity, has led people to focus attention on their homes. With reduced construction and excessive costs of building materials, property prices have been rising in the best buildings.

Going into the rest of the year, we expect these residential dynamics to continue as new construction is hampered by supply side issues. We also anticipate there will be a more liquid land market—particularly for logistics and industrial properties—as the extractive industry grows and matures.

CONCLUSION

Understandably much analysis of Mongolia this year has centred on Oyu Tolgoi. The government of Prime Minister, Oyun-Erdene, seems to have scored a significant win by securing an exemption owed by the government to the investment consortium. All signals suggest the project is now on track and will end up being one of the single largest copper mines anywhere in the world. At the moment (from an open pit) it produces 146,000 tonnes per annum. Once the underground mine is open, it will produce 480,000 tonnes annually. Combine this with the potential to access higher grades, and the effect on the Mongolian economy could be seismic.

But it is vital, Mongolia is not a ‘one trick pony,’ interesting only because of a mega project. It needs to have more OTs, and more diversification. The pandemic has underscored Mongolia’s vulnerability due to its infrastructure. Even in supportive circumstances, it fails to reach its capacity because it does not have the routes to market it needs. The Beijing-Ulaanbaatar agreements of early 2022, which are actually yielding tangible results this year, are vital (and overdue).

The first part of 2022 has so far been as strong as could have been imagined, on the back of an unprecedented health emergency. 2020 and 2021 damaged the public finances but are hopefully an aberration which will not set back the progress made since 2017. With growth set to push higher, this year, and into 2023 and beyond, Mongolia’s prospects are promising, if not assured.