Back from the Brink: Mongolia primed for another year of strong economic growth

Executive Summary

- ‘Positive’ outlook for the Mongolian economy in both 2018 and 2019, according to the International Monetary Fund (IMF) (Xinhua)

- Mongolia exceeding targets by ‘large margins’ with 5% forecast growth (Xinhua)

- Finance Asia awards the country, ‘Best Investment Attractor’ prize (Montsame)

- Rio Tinto opens new exploration office manned with eighty staff (Montsame)

- Moody’s upgrades the country’s credit rating to B3 from Caa1 (Econotimes)

- All eyes on gold and copper

Overview

As each quarter passes, growth expectations are revised upward, and observers concede Mongolia to be doing better than expected. First, it was confidence brought by the package from the IMF. Then it was commodity pricing. At the point of the latest review by the IMF in March, it was the successful cost cutting undertaken by the Mongolian government last year. Now, Neil Saker, the IMF representative has called for further diversification of the economy (Xinhua). This is going to be one of the greatest tests facing Mongolia’s policy makers. Yet as APIP reported last year, the intent of creating a more plural economic base has underscored the efforts of both legislature and executive. Now, though, is the time for results. Public and private sectors came together in 2017 to ensure growth significantly outshot the sober projections of the beginning of the year. As we look into 2018, with growth of over 5% forecast by the IMF, it is time once more to outperform, and secure the Mongolian recovery. All the conditions are in place, if only the efforts of last year can be repeated, and built upon.

RELATED: MONGOLIA 2017 Q4 UPDATE

Minerals & Extractive Industry

Asides the structural reforms achieved in 2017, the distinguishing feature of last year was the recovery in commodity pricing that helped Mongolia achieve a growth rate exceeding 5% (Xinhua). As APIP reported, coal was a star performer, with one of the largest traffic jams in the world gathering on the border with China. A mixture of Chinese environmental restrictions combined with an embargo on imports from North Korea, led to Mongolia becoming one of the principal beneficiaries of these geostrategic movements. It is therefore, unsurprising momentum in terms of coal pricing could only continue so long. The value of Mongolian coal exports is still significantly ahead of previous years, but has fallen compared with the heights achieved last year. Figures are yet to be released for March 2018, however, the cumulative value for January and February is 25% down on a year ago (NSO). This should not cause undue alarm, but smoothing border and customs regulations will help to maintain current levels.

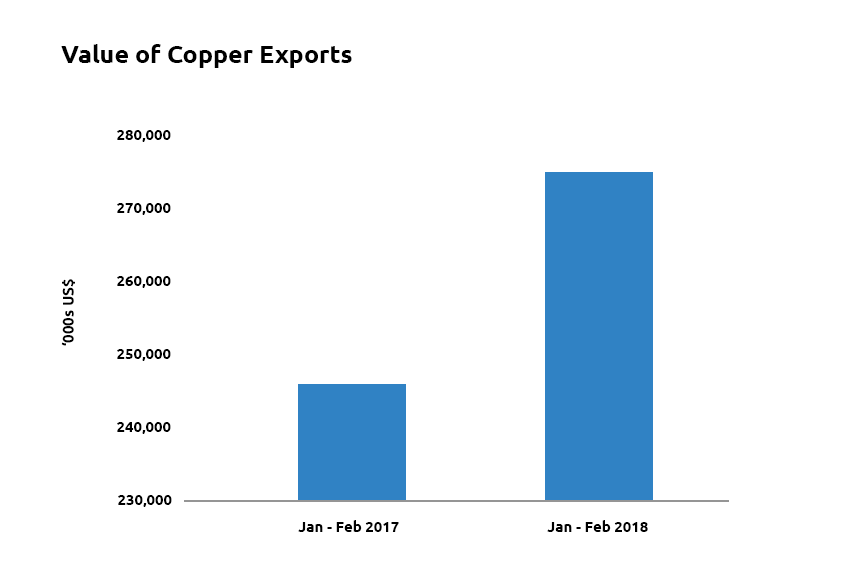

Last year, commentators were right to predict that coal was a short term boon, but the performance of gold and copper were the more important mid-term determinants of Mongolia’s recovery. As Figure 1 shows, copper exports have had a stellar start to 2018, increasing by 135% compared with the same period of 2017 (NSO).

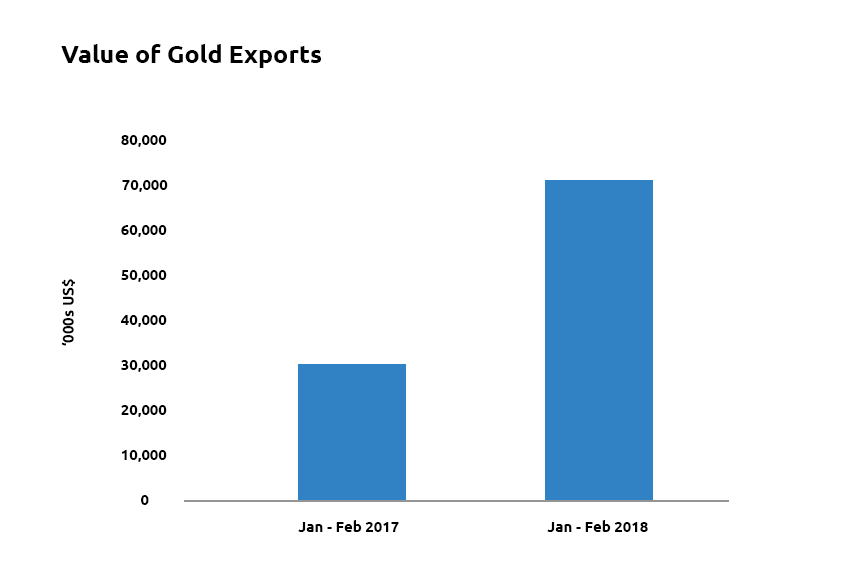

Gold is recognized to be still in its relative infancy in Mongolia, so, though its performance has been more muted, figures showing an 11% increase in the value of exports in January and February are to be welcomed (NSO). The change is shown in below figure.

In terms of export volumes, the results are more nuanced. Coal is down 33%, which is broadly in line with the figure reported for values (NSO). Copper is down by 15% in January and February 2018 as compared with 2017, and so the uptick in overall values appears reflective of the grade rather than quantity of copper exported (NSO). This is in line with expectations of the development process of Oyu Tolgoi, in particular. Gold figures published by the National Statistical Office of Mongolia (NSOM), are in the process of being clarified for the month of February. Taking January in isolation, however, 24% more gold was exported relative to a year previously (NSO). As this industry begins to evolve, it should make a notable contribution to the broader performance of the Mongolian economy.

Investment continues to come into the extractive industry in Mongolia. Xanadu Mines- listed on the Australian Stock Exchange (ASX)- has continued exploration of its Kharmagtai project in southern Mongolia, with early indications pointing to a ‘district scale trend’ with potential for significant copper and gold discoveries. Alongside its drilling, Xanadu is seeking a dual listing on the Toronto Stock Exchange (TSX) (Proactive Investors). Rio Tinto, continues to work on its joint venture at Oyu Tolgoi (OT). Mongolian authorities are keen to ensure power for the project is sourced domestically, and has now enforced this requirement . Consequently, Rio is undergoing the process necessary to gain relevant permits to construct its own power plant at the mine itself, with significant investment billed for 2019 and 2020. Kincora, has also stepped up its exploration in Mongolia hoping to leverage its higher risk appetite to outsmart some of its larger competitors. With 1,400 sq.km. of land, Kincora plans to accelerate drilling activity this spring, drawing on funds raised in 2017. Its CEO, Sam Spring, recently told Reuters of a ‘change in investor sentiment’, as miners sought to explore one of the last great frontiers for copper assets anywhere in the world (Reuters).

Wood Capital Partners is another interesting example of this trend. Speaking to Reuters, its CEO, Stephen Dizard, described its recent distressed acquisition of a 364 sq.km. concession, and subsequent investment running into millions of dollars. Against a backdrop of improved copper pricing and constraints on its sourcing elsewhere in the world, opportunist investors are returning to Mongolia. The much needed injection of funds from overseas to encourage the further development of the extractive industry, is of real consequence for Mongolia’s recovery. Aspire Mining, is also a beneficiary of this. After a difficult few years, it raised a US$16.5m six for five entitlement issue in late 2017, meaning now it is pushing ahead with its Nuurstei coking coal plant, which should be fully operational by mid-2019 (Business News). After problems encountered with its larger Ovoot scheme, Aspire’s ability to raise funds and to continue to commit to Mongolia, underscores the increasing confidence in the macro economy (Business News).

Reform, Consolidation & Market Confidence

In the latter part of 2017, an asset quality review of Mongolian banks was undertaken, prompting some consternation as to unwelcome findings. Much like the restoration of public finances more generally, however, the system was judged to be stable (Montsame). PWC- the authors of the study- considered operational policy, regulations, credit risk management and collateral, and did not report major systemic concerns (Montsame). This bears testament to meaningful reforms alongside a recovering economy.

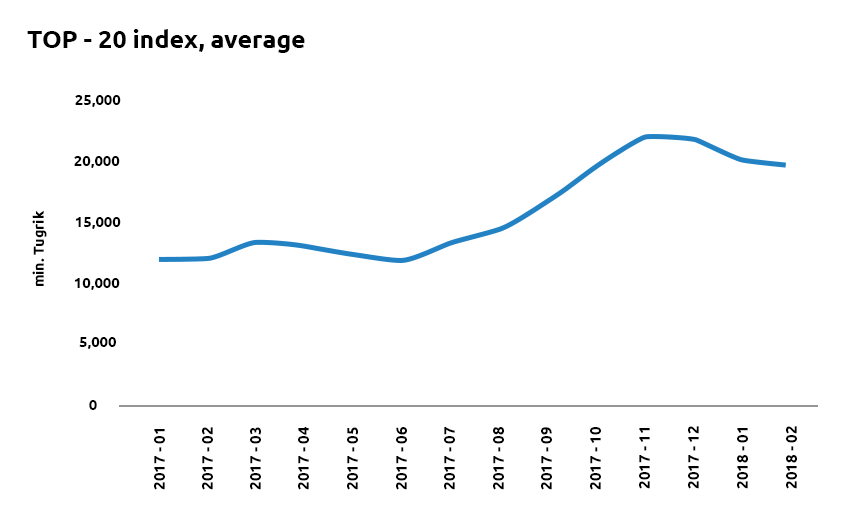

The Mongolian Stock Exchange (MSE) has recently been one of the best performing indices in the world. Though thinly traded it is one of the simplest means by which outside investors can gain exposure to Mongolia. As Figure 3 shows, the top twenty companies by market capitalization are up by over 70% (NSO). Since January 1998 when it was first tracked by the NSOM, the index is up by nearly 6000% (NSO).

In a similar vein, World Economics released its sales managers’ index for Mongolia, showing significant improvements compared with the preceding year. Calculated on the basis of business trust, market growth, price changes and employment, its authors judge Mongolia to be stable (Gogo Mongolia). Another development, likely to welcomed by Mongolian business is plans for tax reforms to support smaller enterprises. In March, Prime Minister Khurelsukh announced that alongside efforts to reduce tax evasion, rates would be cut for smaller entities. The reform will mean 90% of tax paid by companies with incomes of less than 1.5 billion Tugrik per annum, may apply for rebates (AKI Press).

The Heritage Foundation’s Economic Freedom Index has also upgraded Mongolia’s ranking. Its overall score has increased by 0.9 points in response to better monetary freedom, fiscal health, and judicial effectiveness (AKI Press). This builds upon Mongolia’s success in rising four positions in the World Justice Project’s Rule of Law Index (Montsame). Mongolia now ranks seventh out of fifteen countries in the East Asia and Pacific Region on the basis of constraints on government power, absence of corruption, open government, fundamental rights, order and security, regulatory enforcement, civil and criminal justice (Montsame). These developments run alongside Mongolia being removed from the EU’s tax haven blacklist (AKI Press). The list, drawn up in December raised concerns as to Mongolia’s taxation system, but following undertakings from senior politicians, it has been delisted (AKI Press).

Real Estate

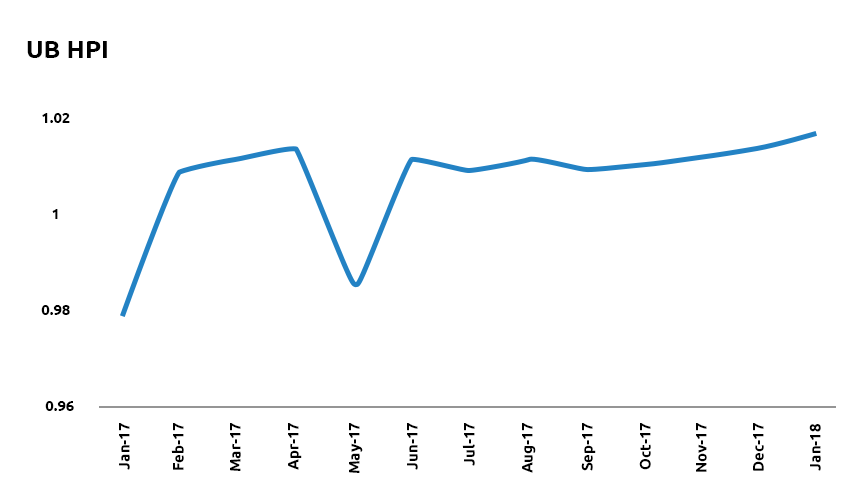

The general house price index (HPI) of apartments in Ulaanbaatar was up 3.5% year-on-year in January 2018 (Mongol Bank). This is a positive development, however, it also disguises other notable trends in a fragmented market. Through our subsidiary, Mongolian Properties (MP), we are seeing stronger price appreciation in the luxury segment of the market. With a perception prices have ‘bottomed out’, investors are seeking rental stock to cater a growing clientele of expatriate workers, and middle-class Mongolian struggling to buy in a mortgage-free market. These two groups are helping to push rental prices upward.

Though small in numerical terms, from an investment perspective the presence of foreign workers has an outsized effect on rental yields at a time when capital values are still low. According to the Visa Department of Mongolia, the number of investors with resident permits increased 16% between 2016 and 2017, whilst applications for extensions were up 18% (NSO). This helps maintain strong rental demand in the best buildings in the city. It is for his reason, it is welcome policymakers rejected a cap of foreign workers for 2018- a well-intentioned, but short sighted policy (Reuters).

City center office buildings continue to suffer low occupancy, as a rush to build in the good years has not been matched by business appetite. In the retail sector, however, our agents are reporting more uptake- and crucially, interest from international brands looking to take space in the city. This is reflective of greater consumer confidence and the prospects of rising wages. In terms of land, we are undertaking a number of feasibility studies for collateral purposes, however, in a relatively illiquid (and opaque) market, reaching fair estimations of value is suppressing values.

Toward a More Balanced Economy

Gross Industrial Output (GIO) continues to improve in Mongolia. Given Mongolia’s climate there are seasonal constraints on activity which can be particularly pronounced. Output peaked in October before dropping over the winter months. January and February, however, in relative terms are still up by 14% compared with the same period of 2016 (NSO). This builds upon the strong momentum achieved over the course of 2017.

For too long, Mongolia has relied on the import of energy from its neighbors. Petro Matad, long active in Mongolia plans to drill four wells in Mongolia this year, which will help to reduce dependence on imports of refined products. Commenting on the announcement, Mike Buck, the company’s CEO claimed Mongolia to be one of the last great frontiers for onshore oil due to the suppression of this industry in Soviet times (London Stock Exchange). Energy security will be vital to the achievement of a more balanced economy in the midterm. With this in mind, Mongolia has now approved plans to build its first oil refinery in southeastern, Dornogovi province (AKI Press). This project has been under discussions since India’s Narendra Modi agreed a loan to finance its construction in 2015 (Ibid). Construction is billed to start in the second quarter of 2018, will be able to process 1.5 million metric tons of oil each year, and could add as much as 10% to Mongolian GDP (AKI Press).

Opportunities in an increasingly globalized world also can come from unexpected quarters. China is currently the epicenter for crypto currency globally, but a succession of measures taken by the government in Beijing have begun to arrest its development. Foremost, initial coin offerings and digital currency exchanges were recently banned, creating space for other countries to step in. Tsolmon Bayaraa recently signed a contract with one of China’s largest crypto mining companies, to initiate a pilot project to deliver 300,000 crypto mining machines in Mongolia (China Economic Review). Asides the debate surrounding crypto currency, developments such as this point to imaginative schemes being pursued by entrepreneurs that could later contribute to a broader industrial base in Mongolia.

Indeed, the development of industries and businesses asides mining remains at the forefront of discussions of economic diversification. Though small in overall money invested, the World Bank through the Mongolian Export Development Project has extended US$400,000 to over 20 small and medium sized businesses. This is only the start, with a total of US$20m ring-fenced for similar projects in the future (Montsame). Of greater immediate interest, was the establishment of a four year program in February to support the Mongolian cashmere industry (Xinhua). Designed to sustain the 5,500 jobs already in the sector- and to support 3,600 new opportunities - it will help domestic processing. Estimates suggest this could help it to become an industry worth as much as US$2bn (Xinhua).

Politics & International Relations

It was a politically quiet first quarter, save for the re-election of former President Nambaryn Enkhbayar as chairman of the Mongolian People’s Revolutionary Part (MPRP) in February. Enkhbayar received full support of the party that he founded in 2010 (AKI Press). But if politics was quiet, diplomacy continued to occupy center stage. In March, extensive meetings occurred between Mongolian and South Korean counterparts to foster increased cooperation (Yonhap News). Coincidental to the 28th anniversary of bilateral relations, there is a push for increased scholarships with Mongolian students and the initiation of new routes for Korean airlines to link Ulaanbaatar and Seoul (Yonhap News). Relations with Moscow remain strong with a recent summit held on enhanced cooperation- in particular the establishment of a joint Nuclear Science and Technology Center. Discussions also continue apace regarding the ‘One Belt, One Road’ initiative sponsored by President Xi Jingping, that will help deliver much needed infrastructure to Mongolia.

Conclusion

At the start of 2017, Mongolia needed a ‘shot in the arm’. After the anemic growth of 2016, policy makers in Ulaanbaatar feared the real possibility of delinquency or outright default. But through coordinated action with the IMF, crisis was averted, at least in the short term. It was difficult to predict the rally in commodity prices we observed last year, but what was perhaps of even greater importance, was the enactment of structural reform to lay the basis for a more sustainable economic future. Mongolia’s public and private sectors responded admirably and targeted growth of 3% jumped to 5% (IMF). As we embark on 2018, there is reason to suppose that sober projections of 5% expansion this year could once more be beaten.

Speaking recently, the IMF representative in Mongolia, stressed diversification as the main challenge confronting legislators and bureaucrats. A long held view, it is especially relevant today. Mining remains the surest ingredient for a prosperous Mongolian future, however, it can be only part of the puzzle. And the foundations have now been laid. Moody’s has upgraded the country with a stable outlook and the IMF reports achievement of targets against the program it established. With economic freedom improving, and the rule of law better entrenched, conditions are being created for companies, domestic and international, to participate further in Mongolia’s recovery.

Whether in crypto currency or cashmere, small enterprise or dairy products, Mongolia is working hard to diversify its economic base, to ensure more sustainable tax revenues, and to create conditions necessary for 8% continuous growth in line with emerging Asia. Confidence is returning, underpinned by economic growth through, copper, gold and coal industrial performance, but compounded by a banking system now judged to be secure. With greater energy security coming on-stream from the development and refinement of oil resources, Mongolian industry will have the opportunity to plan for the future.

And with all these positive movements, this remarkable country, which for too long has suffered an image problem, is restoring its credibility. The stock market is booming. Sovereign debt is trading keenly. Diplomacy is on overdrive. In fact, according to at least one publication it is most successfully attracting investment in all of Asia. Now, however, as in so many cycles previously, is not the time for hubris. Challenges abound. But, this time, so too do realizable opportunities. In a country with extreme continental weather, the long winter can seem to halt activity for a period of months. But as we now move into spring, Mongolia seems not to have suffered complacency, but has worked hard to use this season to good effect. With continued grit and resilience, there is every reason to suppose 2018 will be a very good year indeed.

For help navigating opportunities in Mongolia, please contact Lee Cashell (cashell@apipcorp.com)