Mongolian economic growth has remained resilient in the third quarter, driven by sturdy private consumption, solid FDI inflows and coal exports

- Mongolia’s exports grew by circa 13% (USD 663 million increase in exports) with the foreign trade turnover reaching USD 10.5 billion, in which USD 6 billion were exports

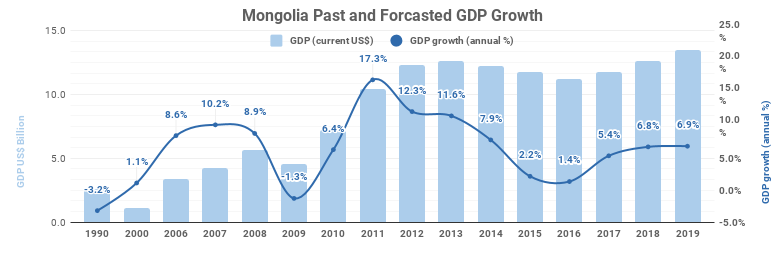

- GDP is expected to be at 6.9% by the end of 2019, according to the World Bank

Source: The World Bank

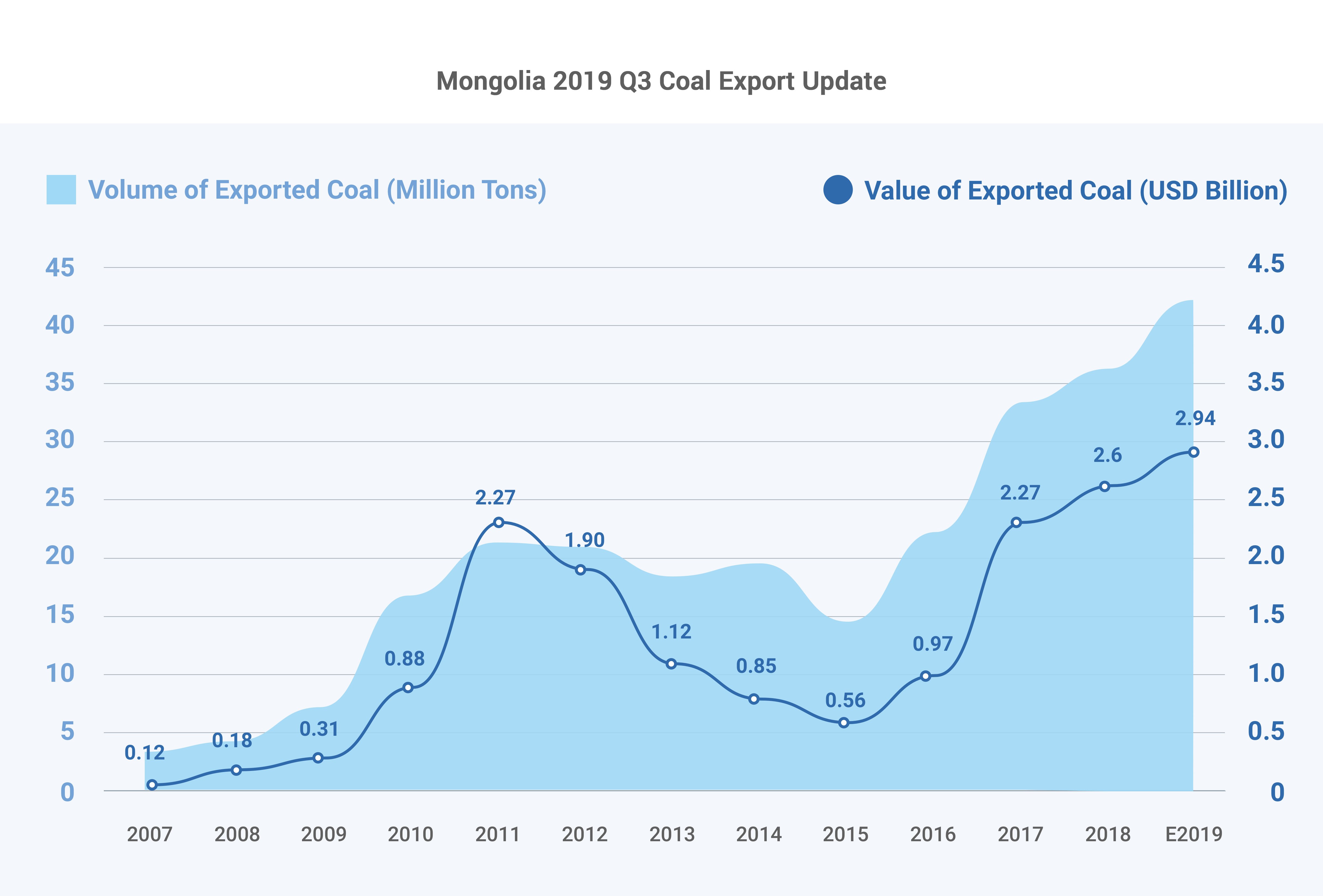

- GDP growth has been significantly driven by an increase in coal exports, which reached 25 million tons in August and are expected to hit a yearly total of 42 million tons relative to 36.5 million tons last year

- Mongolia is predicted to be the top coking coal supplier to China in the long-term in regard to the recently constructed 1,814 km railway, Xiaoji which passes through seven provinces of China

- Copper concentrate and iron ore exports have arrived at 918,900 (USD 1.3 billion) thousand tons and 8.2 million tons, respectively, in the first 8 months of this year. Mongolia ranked 9th globally in copper revenue by meeting three percent of global copper demand.

- Oil export reached circa 5 million barrels and earned USD 272 million

- The Bank of Mongolia's gold purchases are expected to reach 17 tons by the end of 2019

- FDI reached USD 1.3 billion in the first eight months

- Increased private investment and USD 5.5 billion support from multilateral banks have upgraded market confidence

Projected Foreign Direct Investment Inflows in Mongolia / Billion USD /

.png?width=816&name=chart%20(1).png)

Source: National Development Agency

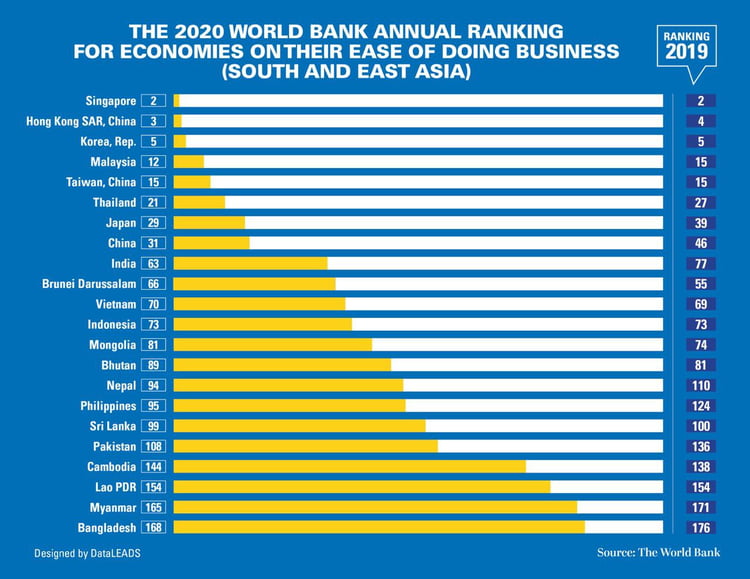

- Mongolia ranks 81th out of 190 countries in the World Bank’s Doing Business 2020 Report

- The FATF on Money Laundering greylists Mongolia regarding its deficient supervision of NBFI and incompetent activities against money laundering. However, no economic or financial sanctions were imposed against Mongolia

- Fitch Ratings keeps Mongolia’s long-term credit rating at “B”, considering it sustainable. According to the Fitch Ratings, political uncertainty is keeping Mongolia's credit rating from being upgraded

- Mongolia and Kazakhstan signed an agreement on building a gold and silver refinery, and seven other agreements, valued at USD 200 million.

- The World Bank finances Mongolia with USD 100 million to move towards a more sustainable development path

- The nation's largest wind park, Sainshand wind park's low and high speed accessories were connected to the central energy network in September, expecting to replace the use of 200,000 tons of coal by providing electricity to 100,000 households.

- Oyu Tolgoi's underground mine shaft II is completed and is expected to advance the development of the OT underground mine. At the same time, Turquoise Hill Resources' stock price increased by 3.5 percent on the New York Stock Exchange.

- In accordance with the first nine months' report of the National Statistical Office, the inflation reached 9 percent throughout the country, which was mainly affected by the increase in meat and meat products' price, budget revenue and financial aid totalled up to approximately USD 2.8 billion

- Starting in 2020, Mongolian government is likely to refinance bonds that are due in 2021, regarding favourable market conditions, predicted by Citigroup analysts. Mazaalai bond debt, valued at USD 500 million with 11 percent interest, will be settled in 2021.

- Ulaanbaatar, the capital of Mongolia has been removed from the top 10 most polluted cities in the world by obtaining the 64th place on air quality among the cities of Osaka, Japan and Vancouver, Canada in 2019.

- The GDP reached US 5.2 billion in the first nine months of 2019, which is circa US $301 million more, relative to the same period last year, driven by growth in industrial, service and construction sectors.