EXECUTIVE SUMMARY

- Mongolia’s total gross industrial output was up 16% in April 2019 versus the same month of the preceding year

- This tracked output from mining and quarrying which also recorded a 17% growth in the twelve months to April

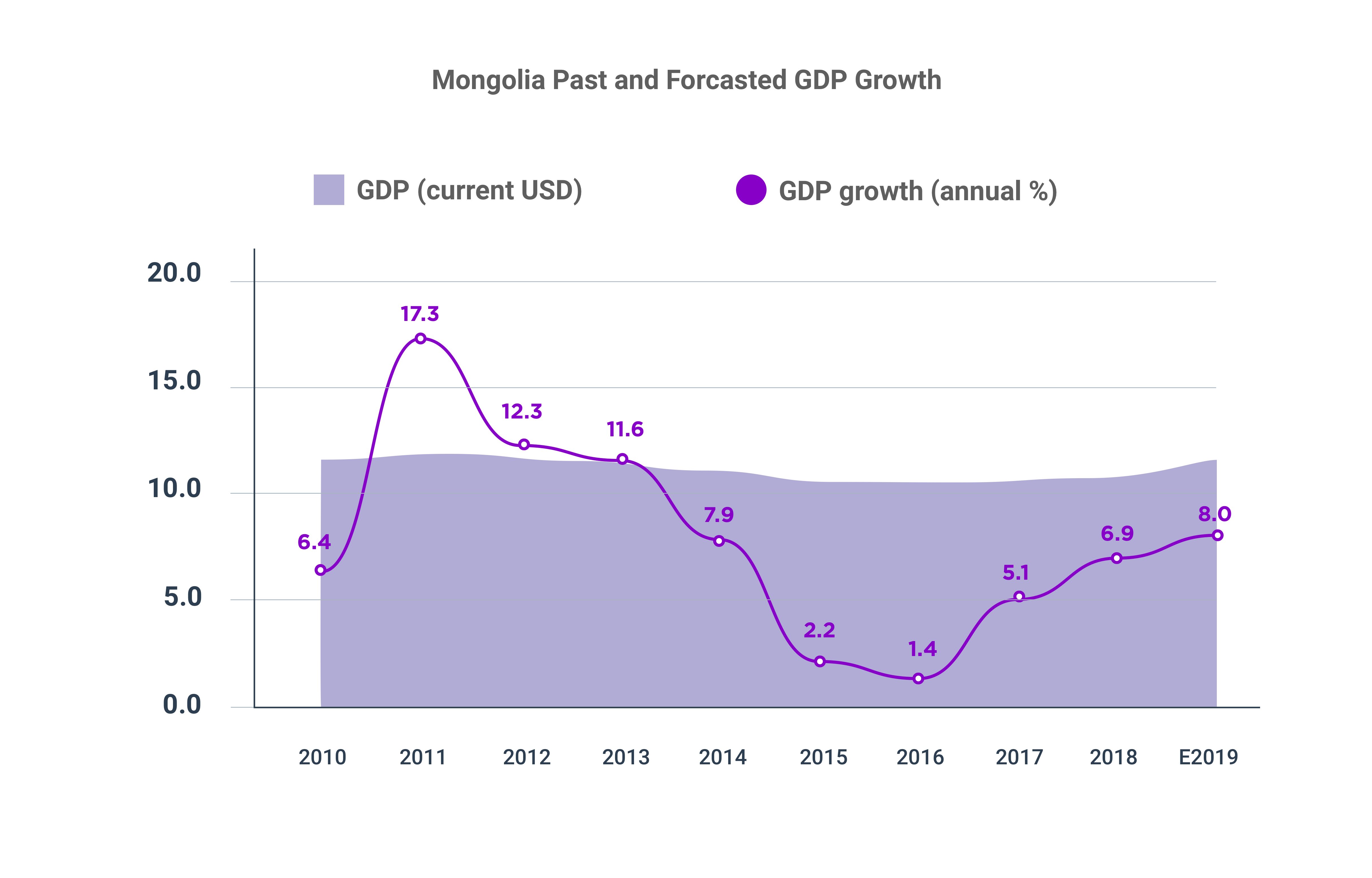

- Gross Domestic Product (GDP) grew 8.6% in the first quarter of 2019 compared with the preceding year

- This was the highest recorded since the third quarter 2014, when it stood at 9.1%

- The Asian Development Bank (ADB) predict 6.7% growth this year and 6.3% in 2020

- Meanwhile, the World Bank predicts growth of 7.2% this year

- Pro-active efforts at diversification and infrastructure, define a country which is learning the lessons of the recent past, and is looking positively to the future

OVERVIEW

Mongolia’s recent recovery has been nothing short of remarkable. In 2018, economic growth hit 6.9%- only a few years after stagnation required a multibillion-dollar bailout from the International Monetary Fund (IMF). The first quarter of 2019 showed Mongolia growing at 8.6%. It is unsurprising a favourable environment for the sale of Mongolia’s main commodities has enabled this expansion. Indeed, reports suggest Mongolian coal exports increased 21% on the back of already strong figures a year ago. What is more striking is how this has filtered into other areas of the economy. For this same reporting period, wholesale and retail trade grew 14%, suggesting renewed consumer confidence. The figures are reinforced by statistics which show an 11% increase in total monetary income per household between the first quarters of 2018 and 2019. As a private investment company, focused on real estate, this is an encouraging development.

For analysts who track Mongolia, the experience of the last few years, is projections from international organizations tend to err on the side of caution. In October 2018, the World Bank forecast Mongolia would grow at 6.6% in 2019. Its Senior Economist for Mongolia, Jean-Pascal N. Nganou, has now revised his expectations up to 7.2%. There is reason to suppose this figure could climb higher, as it has done consistently since 2017. Indeed, the CIA World Fact book suggests Mongolia will be the ninth fastest growing economy in Asia this year, and the 14th globally. Even within a margin of error, these kinds of results would be a vindication of the efforts of public and private sectors in recent years.

For analysts who track Mongolia, the experience of the last few years, is projections from international organizations tend to err on the side of caution. In October 2018, the World Bank forecast Mongolia would grow at 6.6% in 2019. Its Senior Economist for Mongolia, Jean-Pascal N. Nganou, has now revised his expectations up to 7.2%. There is reason to suppose this figure could climb higher, as it has done consistently since 2017. Indeed, the CIA World Fact book suggests Mongolia will be the ninth fastest growing economy in Asia this year, and the 14th globally. Even within a margin of error, these kinds of results would be a vindication of the efforts of public and private sectors in recent years.

Asides debate as to a few percentage point movements in either direction, what is most encouraging, is the actual statements from Nganou. There is praise for the stabilisation of foreign direct investment (FDI), large scale infrastructure projects, and reform of public finances. He predicts a softening of growth in 2020 and 2021, but largely attributes this to domestic pressures, resulting from upcoming elections. Given the strides Mongolia has made- and its commitment to the guidelines agreed with the IMF- responsible politics could help maintain and accelerate growth.

Ulaanbaatar, Mongolia

Indeed, the biggest challenge for Mongolia in recent years has not been returning to growth, but harnessing it to ensure it is neither temporary nor fragile. The wild oscillation between being the fastest growing economy in the world and subsequent stagnation, spooked investors concerned by vulnerability in the face of changing commodity prices. Yet in industrial policy, economic diversification, international relations and infrastructure, Mongolia has shown itself reform minded and cognisant of past errors of public policy. Across the spectrum, Mongolia seems to be on a stable path; a path which could deliver the prosperity its resources suggest possible, and enthusiasts, think likely.

COMMODITIES, INDUSTRY AND EXPORTS

Estimates suggest Mongolia has as much as US$2.5 trillion of resources contained under its landmass. Historically, coal has been treated as a short-term medicine to assist growth, with copper as the longer-term guarantor of Mongolian prosperity. Less attention has focused on the development of the gold industry and its potential contribution to the economy. Initial indications in this area are encouraging, including Erdene Resource’s recent drilling programme which it described as ‘amongst the strongest’ results yet achieved at its Khundii gold project. Analysts predict gold will make an increased contribution to the Mongolian economy in the coming years. In the first four months of 2019, gold made one of the largest contributions to Mongolia’s exports. Collectively there was an increase of nearly US$387m, of which US$51m came from gold. Figures are yet to be confirmed by the National Statistical Office of Mongolia (NSOM), but this contribution alone, suggests positive upward momentum

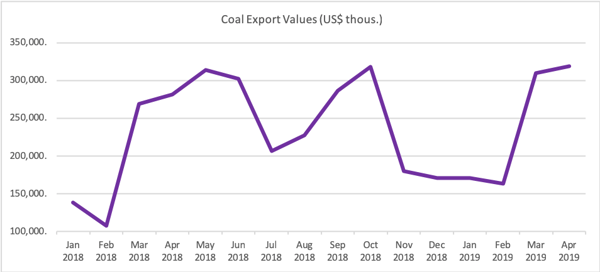

The value of Mongolian coal exports was up 21% for January to April 2019 relative to 2018. Comparing April 2019 directly with the same month in the preceding year, there was a 14% uptick. The change seems mostly derived from better pricing on a per unit basis, since volumes are up only 11% and 2% respectively. The total value of these exports was US$961m. Given Mongolia has already been a significant beneficiary of the increase in value of coal exports in recent times, continued momentum is welcome. Environmental restrictions in Inner Mongolia, and overcapacity in China, serve to underline the role Mongolia can play in satisfying the appetite of one of its closest neighbours.

Figure 1

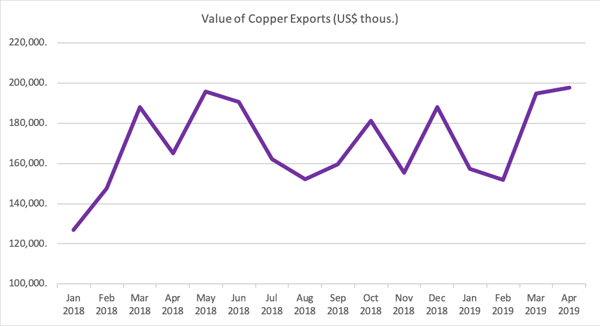

The value of copper exports was up 12% for the first four months of 2019 compared with the previous year. Comparing April 2019 versus April 2018, on a monthly basis, the value increase in copper exports was more pronounced, at 20%. As the development of the massive Oyu Tolgoi mine continues- enabling access to higher calibre copper- it should deliver improved results, for both the project and Mongolia as a whole. It is worth recalling, Mongolia has the thirteenth largest copper reserves in the world, and development of new technologies are likely to position it as a key centre for global supply chains.

Figure 2

Considering exports more generally, figures from January to April 2019, suggest continued progress for Mongolian companies. In this period, Mongolia traded with 130 countries around the world, with total trade turnover of US$4.3bn. Exports saw an increase of 18%, to reach US$2.5bn. Nearly 97% of Mongolian exports were mineral products, textiles, cultured stones and precious jewellery.

DIVERSIFICATION & INFRASTRUCTURE

Since the IMF package in early 2017, stakeholders have rightly identified the need for Mongolia to move toward stable and inclusive growth. The economy is heavily reliant on the performance of a few key commodities, and the appetite of its Chinese neighbour. The IMF’s own stated desire was for Mongolia to attain consistent 8% levels of growth, in line with emerging Asia. Given the rates of growth in 2018, and the early part of 2019, it’s important to understand steps taken in this direction and prospects of success.

Khurelbaatar Chimed, the Mongolian Finance Minister, recently spoke with CGTN, about current policy. There seems little question, Mongolia is in a less fragile fiscal position, compared with a few years ago. Chimed points to the fact government debts amounted to 85% of GDP only three years ago, and now sits more comfortably at 58%. More importantly perhaps, the government is thinking imaginatively about how it can set up new structures to support this trend. Through its stabilization and wealth funds, it is using current revenues to prepare the country for times when commodity pricing is less favourable.

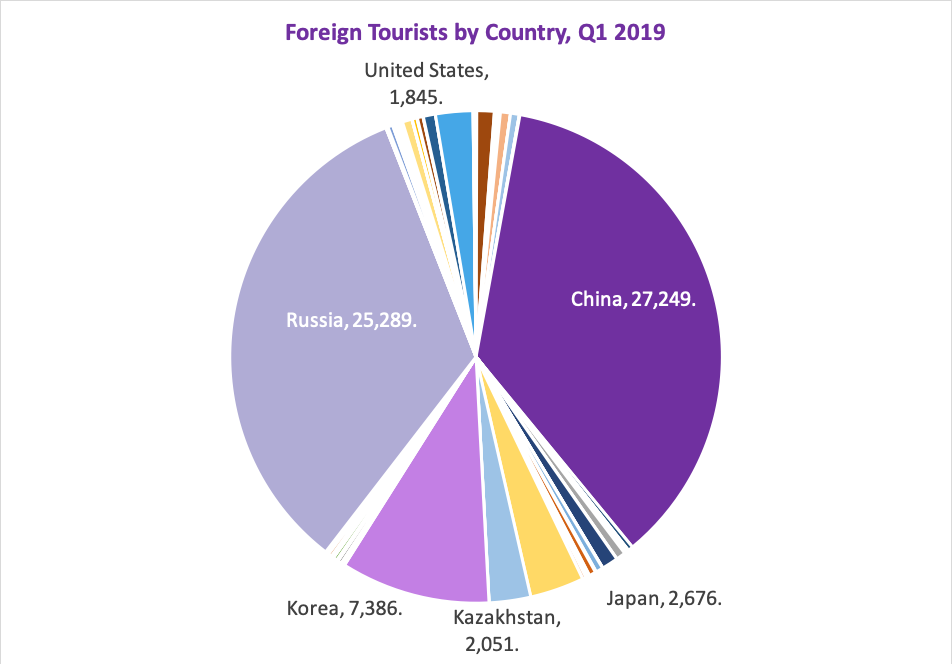

A crucial ingredient in this regard is diversification. One area which should be obvious to even a casual observer is tourism is underdeveloped and could provide a reliable additional source of revenue. The government has set a target of welcoming one million tourists per annum by 2020, generating one billion dollars. Mongolia is a country on a land mass the size of Western Europe, with only three million inhabitants- with nearly half of the population residing in Ulaanbaatar. With striking scenery from the Altai to Terelj, Khustai to Khuvsgul- and one of the largest consumer markets on its doorstep- this industry could be an important part of Mongolia’s future prosperity.

With this in mind, the Asian Development Bank (ADB) has approved loans of US$38m of loans to develop ecotourism projects in Mongolia. Designed to benefit 11,000 residents, the ADB is committed to developing the sector, with a view to providing 149,000 jobs by 2028. Statistics support the growth potential of the sector. Mongolia recorded a modest increase of 7% in the number of foreign inbound tourists for Q1 2019 compared with the same quarter of 2018. The distribution of tourists by country is shown in Figure 3.

Figure 3

To harness this new area of economic activity- and many other emergent sectors- requires investment in infrastructure. At the moment, the country is not as well connected as it needs to be, and the standard and variety of hospitality products are underdeveloped compared with many other parts of Asia. From the perspective of transport, policy makers are excited by the prospect of engaging in Xi Jingping’s ambitious ‘Belt and Road Initiative’ (BRI). This blueprint- designed to open Chinese markets across the globe- requires Mongolia for one of its most important strategic corridors. In the future, leaders in Beijing want to connect China to Europe through road and rail, and Mongolia is an integral part of this plan. Given the statements emerging from the 2nd Belt and Road Initiative in Beijing, where representatives came from Ethiopia and Italy, Tajikistan, Indonesia and many more besides, there is no doubt of the scale of ambition, and the potential for delivery.

Agriculture is also an area where Mongolia is working actively to create value. The Mongolian Minister of Food, Agriculture and Light Industry, Chultem Ulaan, has been laying out plans to increase exports of meat and dairy products to China. China- with a population of 1.4 billion people- has significant requirements for agricultural materials, and Mongolia’s low population density, lends itself to providing some of the shortfall. With this in mind, Ulaan’s department has set ambitious targets as to the development of this sector. In 2018, meat exports were worth US$190m, but the government believes this capacity can be increased to $1bn in the coming years. Given around 50% of Mongolians still work in this sector, the effect of improved agricultural outcomes has a greater reach than pure GDP. From a real estate perspective, it may alter the development of urban areas, and present new opportunities for well financed developers.

The Mongolian government is right to focus on areas which can deliver outsized benefits in terms of economic balance and social uplift. But it also is showing itself to be foresighted in considering other areas of the economy. In May, it launched its fifth Innovation Week, designed at promoting creativity in both public and private sectors. Organized by the Mongolian Ministry of Education, Culture, Science and Sports, the Mongolian Academy of Sciences, the Mongolian National Chamber of Industry and number of universities, it is designed to provide workshops and idea sharing, drawing on international best practices.

In this area, and others, there is an increasing realisation of the knowledge base that exists in parts of Mongolia. Nikkei reports Japanese companies are prospecting for technology talent in Mongolia, given a lack of domestic potential and pressure for the best technicians from India and China. Since 2014, a number of Japanese-sponsored technical colleges have opened in Ulaanbaatar, and a recent jobs fair was held to enable pitches from 29 companies to 140 Mongolian graduates. There is increased scope for interaction, not only in delivering jobs for talented Mongolians but in fostering further interaction between the two countries.

An example of the vibrancy of small business in Mongolia have been two recent Initial Public Offerings (IPOs). Monos Foods- became the first health industry company to list on the Mongolian Stock Exchange (MSE)- seeking to raise c. US$3m for continued expansion. Meanwhile, Inverscore, a Mongolian financial services company, has upgraded its listing to appeal to strategic investors as it takes its fintech-based micro loan platform to other countries in Central and Southeast Asia.

CONSOLIDATION AND REFORM

Mongolia continues to make reforms designed to avoid the excesses of years past. At the start of May, the Mongolian cabinet instructed the Board of Directors of the Development Bank of Mongolia to cease the issuance of low interest loans to commercial banks, and instead focus attention on major projects of national importance. Removing executives with questionable track records, the cabinet has instructed the bank to appoint a credible international team to afford a surer financial footing. This policy decision is aligned with the recommendations of the World Bank.

At a recent economic update meeting held in Ulaanbaatar, the World Bank’s representatives stressed a sustainable financial system was integral to achieving ‘constant growth’. Its report argues for structural reforms in the middle term to increase productivity, foster competitiveness and ensure the vitality of the private sector. Together with this, it cautions of the need to provide programs for the most vulnerable to insulate them in the event of unexpected economic movements. Since, the Mongolian government has announced it will start to provide monthly allowances to all children aged between 0 and 18, to support youth development in a country where 33% of the population are in this age range.

The Bank of Mongolia (BoM) has continued its gold purchase plan in 2019. The BoM bought 1.1 tons in April 2019, representing an increase of 10% compared with the same period of the previous year.

INTERNATIONAL RELATIONS

Mongolia continues to take an enlightened line in its interactions with strategic partners around the globe. Policy makers in Ulaanbaatar and New Delhi have now signed an agreement to support the development of a large oil refinery in Sainshand, in the Dornogobi province. Believed to be one of the largest Lines of Credit (LoC) ever extended by India, the US$1bn scheme will have a capacity of 1.5 million metric tonnes per annum. Geopolitically this development takes Mongolia further along its path toward energy independence, and strengthens its hand it interacting with both China and Russia.

It is not only in the area of oil, though, where there is greater potential for interaction between India and Mongolia. Though there are inevitable questions as to the role coal can play in longer term economic growth, it seems destined to continue to be a valuable resource for Mongolia. Fitch forecasts a slowing of Chinese demand for global coking coal beyond 2028, however, with increased steel production in India, this could pick some of the slack. Projections suggest India’s coking coal consumption will increase by 5.4% annually between 2019 and 2028, making it the largest importer of coking coal by 2025. Clearly there are competing interests at play in terms of how this market will develop, but Fitch predict China, Australia and Indonesia will gradually lose market share of the coking coal market to Russia, India and Mongolia, suggesting the continued resilience of the sector.

In areas of diplomacy, too, Mongolia is moving ahead with the liberalization of visa regimes to support improved relations with its partners. The Ukrainian Council of Ministers has approved an agreement with the Mongolian government to abolish entry visa requirements for nationals of both countries. Alongside this development, Mongolia has also granted Qatari citizens visas on arrival. In physical infrastructure, too, Mongolia is engaging with South Korea. Discussions are underway to involve Mongolia in the East Asian railway initiative which is targeted at supporting reconciliation of the two Koreas. A memorandum of understanding was signed and a working level committee, established.

POLITICS

It would be wrong to not reference the political challenges Mongolia has faced over the course of 2019. At the end of March, the Ikh Khural- Mongolia’s parliament- voted to remove safeguards widely perceived as ensuring the operational independence of the judicial system and anti-corruption agencies. Historically, this position was entrenched by parliament being entrusted with the appointment of the head of the Independent Authority Against Corruption (IAAC), and the President appointing the Prosecutor General. Crucially, in both instances, fixed terms meant they were- notionally at least- protected from political meddling. New legislation enables the dismissal of both posts prior to the completion of their terms. Whilst this has led to criticism from both domestic and international observers, the effect of the change is as yet unclear. As ever, the exercise of the legislation will likely provide a clearer indication of whether it genuinely merits concern.

Parliamant Building, Central Square

This development, though, should not obscure all other actions taken in the political arena. Mongolia has a vibrant democracy with a pedigree dating to independence, and it would be wrong to cry authoritarianism as some of the press seem inclined. Indeed, there are recent examples of the country pushing for measures likely to reduce venality and malpractice. The rules on ethics of state administrative and civil servants has been amended to prevent gambling either domestically or internationally. More relevant from the perspective of major investors- locally and internationally- has been the draft law on procurement adopted at a plenary meeting of parliament in March.Highlights, according to a report in Montsame, include:

- Government ministers to be kept away from the tendering process;

- Transparency to be increased;

- Pre-procurement activities to be increased to expedite the approval process;

- Blacklisting to be implemented for non-compliant businesses;

- E-tendering to be refined and improved.

All of these steps echo the statements of the IMF, in its suggestions as to how Mongolia should develop in a more equitable, and less secretive manner. What this move underlines is that it can be easy to cry foul at outwardly regressive legislation, but often this ignores less saleable, but positive, news stories elsewhere.

REAL ESTATE MARKET

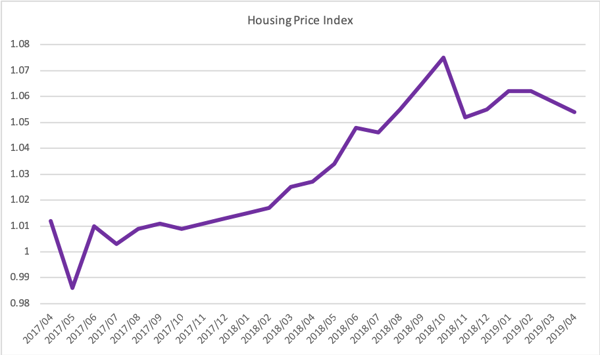

According to figures from Mongolbank- the Central Bank of Mongolia- there was a 2.6% increase in house prices in April 2019 relative to the same month of last year. Though this is interesting- and chimes with reports, anecdotal and empirical of improved consumer confidence- the change since 2017 is notable since it shows a consistent growth rate. Though there has been a reduction since the high recorded in October 2018, levels are still at their highest levels since early 2016.

Yields for prime residential units, had been climbing since early 2017, however, this has accelerated due to constrained supply and increased interest from foreign workers residing in Ulaanbaatar. Not only expatriate workers, though, are pushing yields higher. The mortgage market in the country remains challenging, and many first-time buyers are struggling to save the capital required as a deposit. The consequence of this is, many Mongolians in good jobs, with good prospects, are residing in the rented sector and competing with incomers for the best properties. This is making residential real estate investment attractive for many of our international clients. This is not to say measures have not been initiated to support mortgage lending. Around US$24m of funds were disbursed to around 800 borrowers in the first four months of 2019. Though welcome, this does little to change the systemic issues in the mortgage market in Mongolia and corresponding supply and demand dynamics.

In the retail sector, there was record consumer expenditure during the Tsagaan Sar holiday, reflecting improved perceptions of the state of the broader economy after years of difficulties. In our own experience, there is renewed interest for prime retail units in our flagship building, the Olympic Residence, in Sukhbaatar District. We are also observing improved fundamentals in Chingeltei and Zaisan, with the Mongolian consumer class keen to access the best local and international brands. Office remains a challenging sector due to the glut of oversupply in the years leading up to the financial crisis. There is competition for some of the best space in the city, but this is a limited pool and will likely take some years to still recover.

As Ulaanbaatar continues to develop a pace- in large regard owing to mass rural to urban migration- there is renewed interest in the land market. We have undertaken a number of assignments for international and local entities considering land parcels in the city, particularly those along the Yarmag Road, on the approach to the airport. With anticipated growth in the coming years, driven by the minerals sector in particular, there is a requirement for warehousing and industrial properties, and an ever-greater need for low- and middle-income housing. Pollution in the city, in part due to the large number of temporary settlements, has led to public disquiet and movement to act by government bodies and Non-Governmental Organizations (NGOs). We anticipate moves toward more efficient land use planning will lead to greater interest in land assets in the midterm.

CONCLUSION

Mongolia’s path to recovery can be traced to early 2017, when policy makers gathered with international partners to lay the basis for reform. The policy package, though, was an agreement between parties and not a schedule of demands placed on Mongolia. Ultimately, it was still up to the government to ensure noble intentions were translated into tangible results. There were many potential obstacles- changes of legislative and executive power, and the looming question as to how commodity prices would affect an economy, so predicated on Chinese trade, and the value of its minerals. But as that year progressed, concerns were assuaged, targets met, and estimations of growth repeatedly revised upward.

2018, by any barometer, was a successful year for Mongolia. 6.9% growth. Foreign trade up 22% year on year. A succession of announcements as to the initiation or acceleration of activity by junior and senior miners. New procedures for investment and fiscal policy, and support for diverse areas of the economy from the uranium industry to dairy, cashmere to wind power. The question confronting policy makers and investors in 2019, is what constitutes success and when will we be able to tell whether this year can emulate the success of the last two.

So far, the indications are positive. GDP for the first quarter of 2019 is up 8.6% compared with the same period of the previous year.Encouragingly, this was not simply the product of improved industrial and construction performance, but also due to an 8% increase in the service sector and a 13.9% increase in the wholesale and retail trade sector. This together with reforms to taxation led to a 29% increase in the tax take for this period when compared with last year. The balance of payments was also in surplus by US$219m- a significant improvement from a year earlier.

None of this should detract from the real challenges facing Mongolia. Non-performing loans in the banking sector are up markedly from last year, and even show an increase month-on-month. Reforms are ongoing and the possibility of diminishing demand for the global commodities Mongolia has in abundance, present obvious headwinds. This combined with the electoral cycle potentially disrupting society and economy, must be acknowledged by even the most enthusiastic advocates of Mongolia. But against this backdrop, the change should not be understated. A couple of years ago, it seemed far from sure Mongolia would be able to agree a multinational package of assistance, let alone return to the levels of growth it has more recently shown. With prudent policy majoring on investment and fiscal discipline, Mongolia is primed for another year of substantial growth. As the country warms up after a long winter, its economy moves into its most productive season, with optimism and resolve.