Struggling to find reliable returns affects all investors. Volatile investments, currency risk and the need for diversification present challenges for individuals and families. Real estate has often been shown to have a low correlation with the performance of other asset classes- and can be one of the first to outperform when an economy recovers. We looked at five reasons you should consider investing in residential property in UB, now.

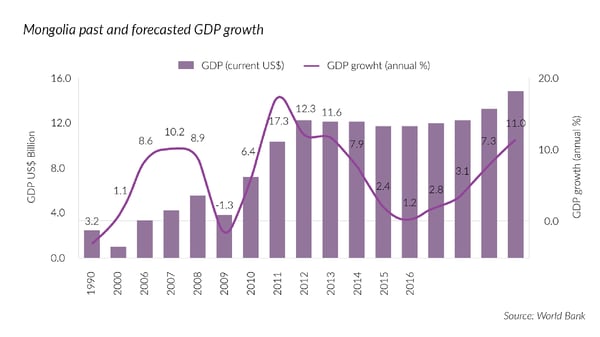

1. Mongolia’s economy grew at an average 7.7% per annum in the past decade and is expected to reach 8% by 2019

In 2009, the government of Mongolia signed an investment agreement with Oyu Tolgoi mine, which contributed to the Mongolian economy growing at 17.3% in 2011. The second phase of the investment agreement was signed in December 2015 with Rio Tinto, with an additional US$ 4.4 billion to finance the underground operations at the mine. The deal is encouraging for Mongolia’s economic prospects since Oyu Tolgoi is expected to produce up to 30% of its annual GDP once it reaches full production capacity in 2021.

2. Continued increase in demand for real estate

GDP growth has dramatically increased the purchasing power of locals with incomes increasing over eightfold in the past decade. Mongolia has a small, but growing, nouveau riche, and an entrepreneurial and political class, demanding international-standard, luxury accommodation. Wages have kept pace with overall GDP growth and mortgage penetration in Ulaanbaatar is only 17.2%, and 10.2% nationwide. Therefore, expected macroeconomic growth, together with the continuation of the government mortgage program, should sustain demand for residentail apartments in Ulaanbaatar in the near term.

3. Mongolia has strong property rights and an appealing tax system

Mongolian property laws are comprehensive and well-drafted with excellent protection of title and ownership rights. Employing a ‘floating freehold’ system, the constitution and other major laws provide both foreign and Mongolian citizens with inalienable freehold rights to immovable property. There is no distinction between local and domestic purchasers in the legal system in terms of property rights.

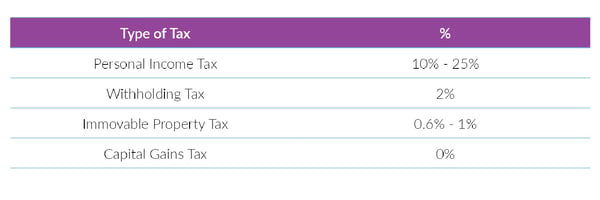

Additionally, in an effort to attract and sustain the inflow of foreign capital into the country, the Mongolian government has implemented one of the most generous foreign investor tax regimes in the world. This benign and simple system creates an organic environment for business to grow. The rates of taxation in Mongolia are some of the lowest in Asia. The following four taxes are applicable to property purchases:

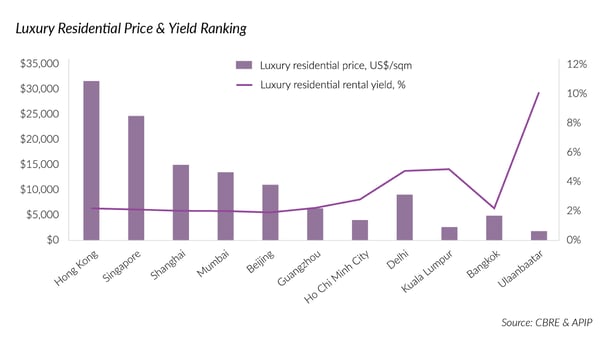

4. Compared to other emerging markets, Mongolian real estate is competitive in terms of rental

yield and affordability

As the political and economic capital of Mongolia, Ulaanbaatar is expanding fast. Unlike peer cities in Asia, however, capital prices are competitive, and rental yields, high. With a growing number of expatriates in the city on a temporary basis, the leasing market is buoyant for high-end units.

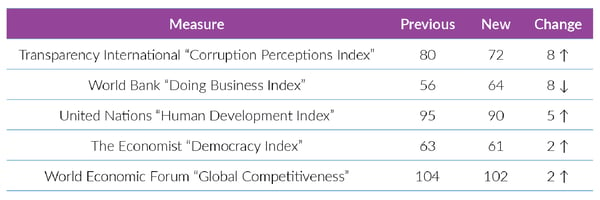

5. Mongolia is democratic and politically stable

With a democratic political system, Mongolia is arguably the most stable state in Central Asia. In order to attract foreign investment, the government has adopted best-in-class legislation, to create a favorable business environment. As a result, the country continues to advance in all international institutional surveys and studies as shown in the table below. The one exception, is the ‘Doing Business Report’ from the World Bank, where corporate disputes with government in recent years may have adversely affected the score. We hope this will improve next year, as the new government is showing itself receptive to international investment.

Please find more information on 2018 Real Estate Guide to Ulaanbaatar