It is exciting to own your first house, but the buying process can be scarily unfamiliar. Compared with renting, owning a house gives you much more control over the property and can be a good investment strategy. However, “with great power comes great responsibility.”

As a homeowner, you will need to pay fees unfamiliar to renters, keep the house repaired and safe to live in, and risk losing wealth if the value of your house drops. To prepare for homeownership, here are eight things you can do when buying your first house:

Location, location, location

A common saying in real estate goes “there are three things that matter in real estate: location, location, location.” It is a rule many real estate professionals stand by today, and it is especially important for home buyers. Home buyers can renovate the home they have bought, but it is impossible to change the location without buying another home.

The perfect location can be different for everyone, depending on your preferences and situation. For example, if you are planning to start a family or have children already, proximity to a good school will be important. Depending on your preferred mode of transportation, a solid public transportation system may be important.

Before you look at specific houses, making a list of what you need in the city or environment around you can help you find areas where you would live more conveniently.

If you are treating your first house as an investment, there are even more things to consider. The goal is to maintain or grow the value of your home. In this case, even if you do not have children, you may need to care about nearby schools, because that can affect the value of your house.

Thinking about the demand and supply of houses in your area is key. Is there more people coming into the area than leaving? Is there a lack of land for building new houses? Both of these signals would indicate the value of houses in the area could go up. A real estate agent can help you answer these questions, but we will discuss real estate agents later.

Dream house

As you start looking at house listings, you might notice there are different types of houses. The major categories are single-family houses, townhouses, and condos/apartments. Which house type to target depends entirely on the market you are in and your personal preferences. For example, finding a single-family house in New York city, USA or Ulaanbaatar, Mongolia can be difficult and expensive.

You may also prefer to live in a townhouse or condo, especially if you are excited about joining a community or would like shared resources such as a pool or gym. If you are planning to buy a townhouse or condo, make sure to talk to a few residents to get a feel for the community and decide whether you would enjoy the community and fit in.

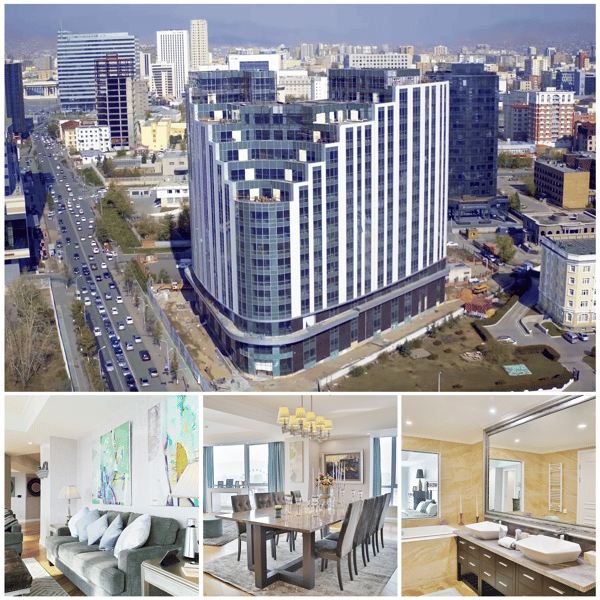

|

| The Olympic Residence in Ulaanbaatar, Mongolia is an apartment building that not only houses many residents, but also contains a mall and other amenities for the community. |

In addition to the type of house, think about what you want inside your house. How many bedrooms do you need? How many bathrooms? Make a list of everything you absolutely need. This will help you make quick decisions about houses that are not a good fit for you, no matter how good the facade looks. If you choose to use a real estate agent, this list will also help him/her find you houses.

When you have a few high potential houses, make sure to drive by at various times of the day to gauge the noise level or any regular activities during the day.

For example, if the house is near a highway, make sure the sound of cars do not bother you. Truck drivers at night may disrupt your sleep. Driving by also helps you experience the traffic. If you will be commuting by car, how good or bad the traffic is can affect your daily life.

In addition to driving by the house, take some time to walk around the neighborhood. This will be your permanent home for at least a few years, so you need to feel safe and comfortable walking around during the day and night. Also take this opportunity to talk to potential neighbors going on walks.

Costs

Homeowners have many more types of costs than renters, and these can change depending on your location or house type. Before deciding on a house, make sure you understand all the fees you will need to pay to buy and maintain the house.

While buying and settling into the house, approximate taxes, home insurance, realtor fees, furniture and renovation costs, and title and settlement fees. Paying for title insurance or a title fee ensures you are financially protected from potential lawsuits that attack your ownership of the property.

To estimate how much you need to pay for renovation, keep track of changes you would like to make to the house. Keep in mind it may be cheaper to buy a more modern house than renovating an older one. When you attend open houses, make sure to ask about how old the appliances are to find out if you may need to replace them.

In addition to the costs of purchasing and moving in to your new home, make sure to consider the cost of living in it. Don’t underestimate the cost of utilities. Even with the same rates, a different house with different ceiling heights, different shower-heads, and different windows can affect how much water and energy you use.

To get a sense of utility costs, you can request the bills for the past 12 months from the energy company.

Some houses, especially townhouses, condos, or those in a gated community, will have Home Owner’s Association (HOA) fees. If you are in the UK and plan to use a TV, you may also have TV license costs.

-257583-edited-281106-edited.jpg?width=600&name=Regency1%20(1)-257583-edited-281106-edited.jpg) |

| The Regency Residence in Ulaanbaatar, Mongolia has a gym which may be another monthly cost that needs to be accounted for |

Even if you are familiar with these fees, they could be different from what you have historically paid. HOA fees may also grow in the future, so make sure to read the documents from the HOA carefully. Find out exactly what those fees will be in your potential new home and how they might change over time. These will affect the affordability of the house.

If you are getting a loan or mortgage on the house, also think about those periodic payments. You can contact your bank for a mortgage in principle, which is what the bank expects to be able to lend you, before even looking for houses. Before buying the home, get a preapproved mortgage to accurately estimate how much you might be paying.

When you get a good idea of your budget, stick to it. Do not get obsessed with a house until you are sure it is within your budget. The emotions surrounding your first house may twist your decision making. Keep your budget in mind the entire time you are browsing houses.

Try not to spend your entire budget. Leave some money for emergencies or other unexpected costs during the buying process. Depending on how you have defined your budget, you may also want to leave some money to continue living the lifestyle you have been living so far. A big change can be hard to adapt to, and you may end up spending more money than you meant to.

If money is a serious issue for the house you need, you can consider sharing a larger house with another family. In some cases, you may also enter a shared ownership scheme. In this arrangement, you own part of the house and another person owns the other part. You would pay the other person some rent on the part of the house you do not own.

Using a Real Estate Agent

You need to make the decision whether to use a real estate agent. They are not mandatory, but can take away a lot of the hassle of buying a home. This decision, again, depends on your situation. The concern with real estate agents is that they are not always on your side.

They are for the most part, but they may hurry you into a purchase even if you are not completely satisfied with the house or the price. They may do this because they would like to get paid earlier and move on to the next buyer, or the extra time spent on finding a marginally better house or price may not be worth it to the real estate agents.

Paying for a real estate agent can also be a waste of money if you know the real estate market well and are happy filling out the paperwork by yourself. This can be risky because you may not catch all the details an experienced agent would. Furthermore, in support of real estate agents, they can save you a lot of time with the paperwork.

|

| A Mongolian Properties agent shows pictures of an apartment the client may be interested in |

Tsatsaral Tsogtbayar, a Mongolian Properties real estate agent, says real estate agents are important “because [buyers] don’t have the information about Mongolian law, experience buying apartments...and they would miss out on a lot of service.”

Experienced real estate agents know the industry well and can help you find your perfect house in an area you had never thought of. If you are treating your first home as an investment, real estate agents can be especially important because they have their pulse on the market.

They understand roughly how many buyers and sellers are in the area, and what are the key factors affect house prices in the area. Discussing your plans with your agent can help you make a better purchase for the long term.

Beyond paperwork and finding a house, the agent represents you and can negotiate for a better price. They will want to make you happy, because real estate agents typically find clients through referrals.

Therefore, if you are beginning to look for a real estate agents, reach out to friends and family first. See if anyone in your social circle have used a real estate agent they have been happy with.

Feel the market

Once you have narrowed your choices down to a few locations and the type of house you want, take a little time to learn the market. Have a look on a multiple listing service to get a sense of how much houses are selling for in the area. Take special note of houses that are most similar to the type you want to buy.

The most important thing is to not get drawn in completely by the first decent house you see.

This research will help provide you with many more choices for your first house. Even after you find a house that seems perfect for you, there may be another house just around the corner with something you never thought you needed.

Looking at all the houses in the area that have been recently sold and are on sale can also give you a sense of house prices in the area. This will give you a good idea of what you can negotiate during the buying process.

Understanding whether you are buying in a seller’s market or a buyer’s market can help you buy the house faster or at a lower price. This is where an experienced real estate agent can be especially handy. A seller’s market typically means there is a shortage of houses. The sellers have more control or leverage. A buyer’s market means the exact opposite.

In a buyer’s market, you have more power, so you can negotiate the price lower than the asking price. You may also be able to force the seller to cover some costs that come up during the buying process, including title insurance or house surveys. Don’t get too arrogant, because there are other buyers out there. Even in a seller’s market, there may be many buyers fighting over one house.

In a seller’s market, you are at a disadvantage. You will need to get creative to stand out among the other offers the seller is getting. Examples include sending personalized letters to the seller with offers of letting them stay in the house for free while they move out. The key is to incentivize the seller to finish the sale quickly, before other buyers get a chance to drive the price up.

As a first-time home buyer, you can be more attractive to seller’s real estate agents, because you do not need to sell your current home before moving into the new one. This takes away a lot of the potential for delays in the buying process. Keep this in mind and communicate it to the seller appropriately.

Another thing sellers want to see in a buyer is a pre-approved mortgage. This lets the seller know that the buyer is fully capable and serious about buying the house. Again, this will speed up the buying process.

House surveys

Many home buyers skip the survey of the building and/or the land, but these are important sacrifices now to protect you from significant future costs. A survey of the building will reveal any structural defects, like rotting floor or a leaky roof.

|

| Park View Residence in Ulaanbaatar, Mongolia has a rough exterior, nice interior, but most importantly, has strong structures. Beware, great looking buildings may be hiding weak support structures. |

If you conduct a survey before finishing the buying process, you could leverage this knowledge to negotiate with the seller. You can force them to be financially responsible for any necessary repairs. Even if you need to increase your price a little, using a survey to force the seller to make repairs may be advantageous to you.

A land survey informs you of the exact dimensions of the property. The seller may not be certain about the dimensions of the land, and you cannot be certain until you have ordered a land survey. Keep in mind that a fence does not necessarily indicate the edge of your land. Understanding the true boundaries of your land can keep you from getting entangled in a lawsuit in the future.

Timing

After you have chosen your house and have begun the buying process, be prepared for delays. Delays can come out of anywhere. For example, the seller or tenant may need more time to move out. Or, repairs that are part of the deal have not been finished.

Because of the many possible delays, make sure you are not ordering heavy furniture to be delivered to your new house, unless you can be sure the house is ready for you. Also, it would be frustrating to have moved out of your old house and not have anywhere to live for a few days, because your new house is not available yet.

Buying your first home can be a scary experience, but with good preparation, you can turn it into an adventure with lots of learning. Keep in mind all of these tips, and you should not get any unfortunate surprises. After purchasing your first home and moving in, remember to change your home address with any institutions that need to know. Good luck!