..and how Trump’s North Korea policy is helping drive Mongolian growth

Beijing-Ulaanbaatar-Beijing-Ulaanbaatar. Round after round of talks, convened and reconvened, ever since Mongolian independence. This is a relationship not without friction- only two years ago the visit of the Dalai Lama prompted an effective closure of the border. A border, where around Mongolian exports transit.

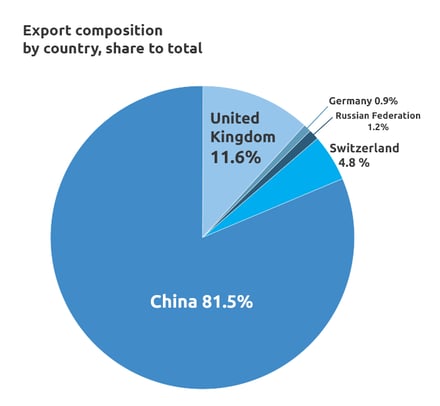

As the chart shows, in 2016, 82% of Mongolia’s total exports went to its powerful southern neighbour. China’s nearly 1.5 billion population requires resources far exceeding those that its own territory can provide. Not only this, but its role as the world’s largest industrial park, has heightened demand. Mongolia has huge natural resources- from copper to coal, gold to uranium. Even zinc and silver. Though imperfectly balanced, China needs Mongolia, and Mongolia, China.

2017: A new dawn in relations

After the wrangling of 2016, China, South Korea, Japan and the International Monetary Fund (IMF) worked together to help Ulaanbaatar get back on its feet. A particularly cruel commodities cycle had led to world beating growth (exceeded only by South Sudan), followed by an almighty slump. But as the ink was drying on a new agreement in February 2017, only the most observant were aware of the massive uptick in exports to China in late 2016. This trend continued apace, equating to a fourfold increase in coal exports in the first half of 2017.

Production shortage in China

Who’d have thought Beijing would begin to let environmental issues drive public policy? Self-interest, and the precariousness of Beijing, forced the closure of hundreds of mines in Inner Mongolia, leaving Chinese industrialists sourcing alternative sources of coal. Simultaneously, decrees restricting the delivery of coal to smaller ports, further exacerbated an already troubling situation. Step in Mongolia. With a vital need to revive industry, a queue of trucks began to form at the border, allowing Mongolian producers to serve the Chinese market.

Ban on North Korean imports

Many industrialists working in the coal business in Mongolia could not believe their luck. But, more was to come. A bellicose North Korean dictator, and a Twitter-happy US President, let tensions flare to an extent not seen in recent years. The latter, promised ‘fire and fury,’ and the former used state media to mock the American ‘dotard’. Against this backdrop, sanctions began to bite on North Korea, not least by limiting, and then stopping, its coal exports to China which had amounted to 20 million tonnes in 2016. Mongolia, again happily appeared on the horizon and helped fill the void.

Trouble ahead?

In 2017, Mongolian coal exports to China were up 27% compared with 2016. They would have been significantly higher, however, had it not been for congestion at the border, and procedural delays in customs and excise. In fact, in December there was actually a year-on- year falls in coal exports, which is very disappointing for producers- not least since mines are gearing up to operate at full capacity in 2018. Political inaction, has, however, given way. It’s now a political cause celebre and slowly, but surely, the trucks are on the move again.

How to benefit?

For a lay investor it’s difficult to directly benefit from the coal story. One option could be to buy equities listed on the Mongolian Stock Exchange- a market that was one of the best performing globally last year. And a market at record highs. Another option could be real estate. There is a real demand for logistics space but this may price out all but larger investors. For retail investors, high quality apartments, are still at a cyclical low in terms of capital values, but are in high demand by renters- both expat workers and Mongolian staff. With yields in excess of 10%, many savvy purchasers are using real estate as their vehicle to benefit from the Mongolian mining story.

At APIP, we’re readying ourselves for a very busy 2018. We’ve now completed the Olympic Residence, have started presales on the Circus Residence, and have a series of consultancy instructions. If you want to hear more about our services, why not book a meeting with one of our team? In the meantime, enjoy our latest quarterly economic update and stay warm in the cold weather!